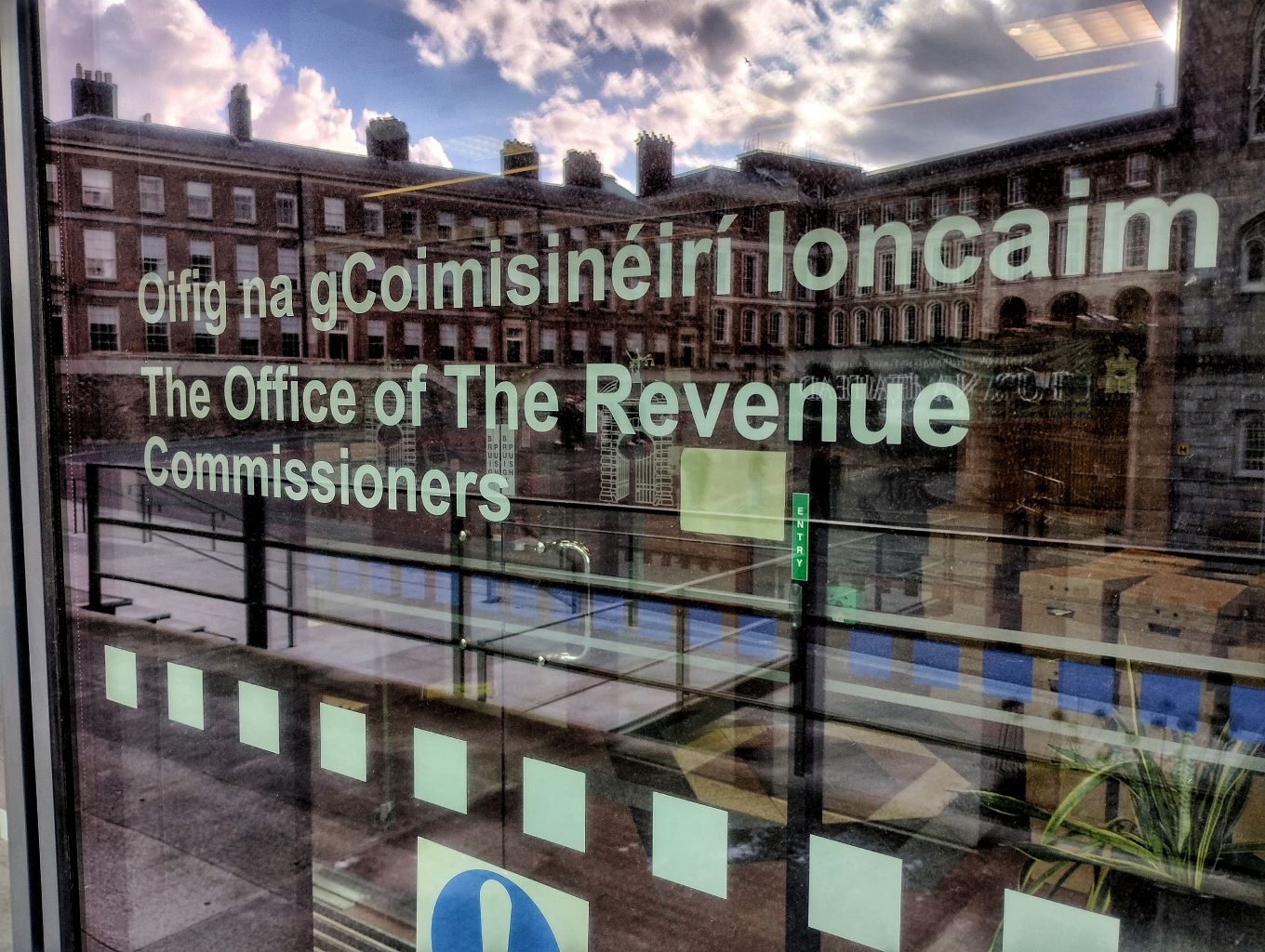

In the final quarter of 2019, the Irish tax authority introduced a new debt management system to allow it to review cases more quickly. Part of the idea was to identify companies that were operating historically in arrears and to get back on track. Many of these companies assumed they were fully compliant. They paid their taxes, even if it required a nudge here or a letter there. But, based on Revenue’s analysis, these companies, falling slightly outside the compliance cycle, were those most at risk in the future. The new system was designed to help. In the first quarter…

Cancel at any time. Are you already a member? Log in here.

Want to continue reading?

Join today and get full access to The Currency and The Wall Street Journal – TWO premium memberships for the price of one.