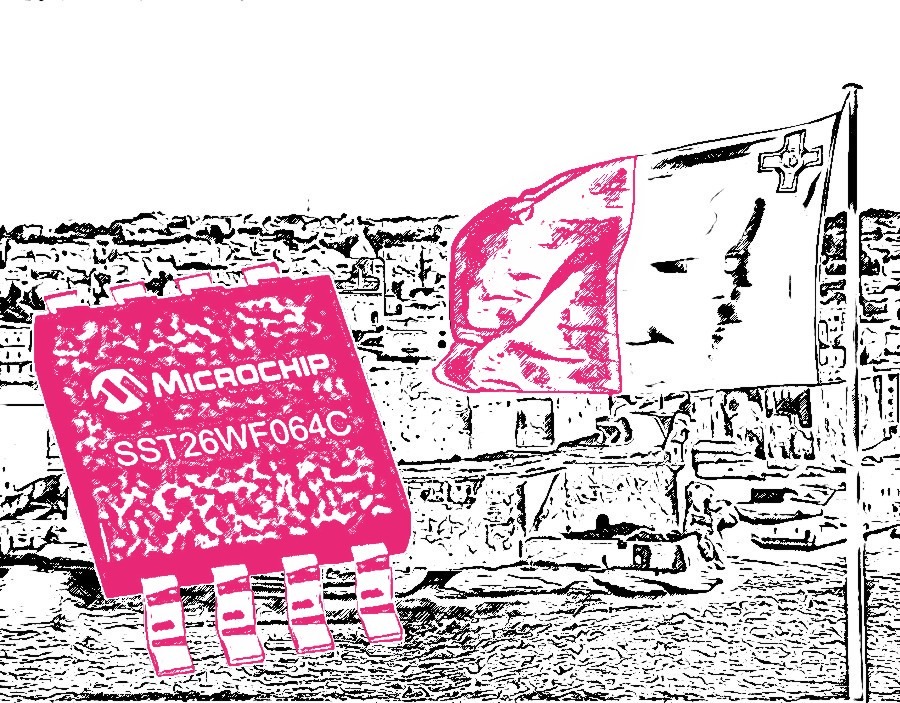

When The Currency revealed last October that the US semiconductor giant Microchip was restructuring its double malt tax structure valued at $27.9 billion (€25.9 billion), one question remained unresolved: Where, between Ireland, Malta or the US, would the group book international profits and pay corporation tax in the future? On January 12, High Court judge Mr Justice Denis McDonald approved the cross-border conversion of Irish-registered Microchip Technology Malta Ltd into a Malta-registered company. This change of nationality is a new option introduced by European law: “The board of directors and all the shareholders have decided to take advantage of the…

Cancel anytime. Are you already a member? Log in here.

Want to continue reading?

Introductory offer: Sign up today and pay €200 for an annual membership, a saving of €100.