The most politically charged statement at the all-star MetroLink spectacular staged by the State in Dublin on Thursday came not from the senior cabinet members on hand but from a Kiwi executive, programme director Seán Sweeney. “This is really about nation-building in its purest form,” Sweeney repeatedly told over 600 potential contractors at DCU’s Helix theatre.

Sweeney referenced Irish workers’ history of emigration, including his father’s, to help build the world’s transport networks, and urged international companies to return the favour. He highlighted popular support for the Dublin underground railway project, according to a Red C poll.

He and the wider executive team extolled the project’s expected benefits: jobs, lower carbon emissions, accessibility of new development land for housing, and time savings for commuters.

Their attempt to jolt Ireland into believing again that it can build the infrastructure its population needs, while only a detour towards convincing potential bidders to put their best offers forward, was also a response to MetroLink’s critics.

Economist Colm McCarthy has been one, regularly reminding The Currency’s readers of the dangers of committing to a project whose cost is as yet unknown. On Friday, Colm also quoted two recent vocal opponents of MetroLink, Michael “Dublin Airport doesn’t need it” O’Leary and Dermot “AI will make it useless” Desmond. A reality check is needed here.

The airport is one of 16 stations on the proposed route. This makes O’Leary’s comment approximately 6.25 per cent relevant. The vast majority of intended MetroLink users would not travel to or from the airport (myself included – interest declared). Fingal, the fastest-growing local authority in Co Dublin by population and the third-fastest nationwide, has seen none of the Luas deployment to date.

MetroLink’s proposed capacity is 20,000 passengers per hour in each direction. The accepted maximum capacity on an urban motorway is around 2,000 vehicles per hour per lane. Assuming fully occupied five-seater vehicles, Desmond’s promise of AI-driven cars would need to make Dublin’s main north-south urban street axis as efficient as a four-lane motorway. His comment is as relevant as the probability of this happening. I would currently put this at zero per cent.

For all their business savvy, O’Leary and Desmond are also conflicted. Ryanair charges commissions on bus tickets and car hire. Desmond is an early-stage tech investor. MetroLink’s publicity strategy could do well by promising ticket resales at juicy mark-ups for Dublin Airport-based airlines and facilitating access to its tech contracts for promising start-ups.

More broadly, the two businessmen’s comments are typical of those that usually get airtime when it comes to public policy for Dublin’s Northside: They come from people who only ever set foot there to go to the airport.

Procurement is key

Ignoring them, however, is not sufficient to guarantee MetroLink will be a success. Its procurement is key. And the pitches of political leaders at Thursday’s event were decidedly commercial.

Beyond the inevitable references to Ardnacrusha (Taoiseach Micheál Martin, check; Tánaiste Simon Harris, check), the Government wanted to convince the global infrastructure giants capable of building mega projects who are wondering whether they should put Ireland on their map.

“An important part of that answer is, of course, certainty of funding and the pipeline of projects. As a Government, we’re looking to provide that certainty,” said Harris. He referenced the National Development Plan, which allocated €2 billion one month ago for the “commencement of construction of MetroLink” by 2030.

Martin added: “This is a statement of intent, and one that provides assurance that delivery will commence under this Government. The funding is now in place.” These were bold promises.

Erratic billion-euro corporation tax swings in each of the past four months have shown that nobody knows the shape or size of resources available to the Exchequer in the coming years. A downturn at Pfizer depressed tax revenue in May. Strong profits in the wider economy boosted it in June. July, when no significant taxpayer had made payments in recent years, suddenly became a major corporation tax contributor. August, which was previously aligned with Apple’s steady growth in profits, is now alarmingly volatile.

There is, of course, the commitment to allocate existing surpluses and the €14 billion windfall from the Apple state aid judgment to investment in infrastructure, with MetroLink as a priority. But this project could absorb the entire Apple escrow account and more – the truth is, we don’t know that either.

The procurement process, outlined by MetroLink’s head of commercial policy Lisa Reynolds, will generate feedback from bidders on the price tag they put on the project. Only then will the Government be able to sanction full funding, for what will definitely be a double-digit billion-euro project.

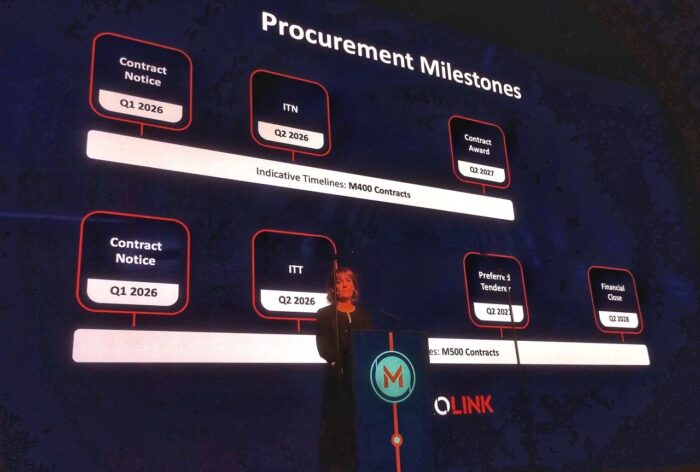

Reynolds detailed three parallel procurement packages:

- enabling works, such as demolition, moving utilities out of the way, and archaeological surveys (multiple framework agreements, qualification systems and individual contracts under the M100 category);

- civils including tunnelling and building the shells of stations (M400, with two contractors to be allocated one half of the line each, on a most advantageous tender basis);

- and a public-private partnership with a service delivery partner to design, build, finance, operate and maintain the rail system onto civil infrastructure for an agreed duration (M500).

The M500 contract will be the largest and most complex, accessible only to an international consortium of companies combining the various types of expertise needed. Conducted under EU regulation 1370 specific to public transport PPPs, its procurement will take longer. Prequalified bidders will enter a dialogue with procurement officials to refine their tender proposals, Reynolds said.

“The preferred tender will be determined based on the most economically advantageous. To enable integration as early as possible between the parties, we will award an early services agreement to the preferred tenderer,” she added, in an effort to speed up co-ordination with earlier phases of the works before financial close of the M500 contract.

The timeline presented by Reynolds aims for all contract notices to go out by next February – though she said this was subject to securing a railway order first. Director of engineering and environment David Hobson added: “An Coimisiún Pleanála has confirmed to the programme team that their final report is with the board.” MetroLink’s team is hoping for a railway order this year.

The elephant in the room was a potential judicial review, just as Uisce Éireann was reeling from a High Court challenge against planning permission for its Greater Dublin Drainage Project launched on Tuesday by Wild Ireland Defence and Catherine McMahon. McMahon had previously objected to the north Dublin wastewater treatment project on her behalf and that of local groups, while Wild Ireland Defence had lodged submissions along with its founder, environmental activist Peter Sweetman.

A similar judicial review could well hit MetroLink’s railway order. Yet this risk was not mentioned at the public event on Thursday.

To alleviate such risks (and reassure the companies that prepared bids for the previous iteration of the project, Metro North, before the Government axed it amid the financial crisis in 2010), bidders have now been promised that their costs would be covered under certain conditions. When I asked about those conditions, a MetroLink spokesperson said this would be a matter for the Department of Transport.

Bidders are biting

So far, bidders are biting. Thursday’s sold-out event was the first of a two-month road show. Minister for Transport Darragh O’Brien will be at the next market engagement in London, for which over 1,000 participants have registered interest. Paris, Milan, Berlin, Vienna, Madrid, and Istanbul will follow, covering the homes of the most successfully built metro networks of recent decades and their contractors.

Already, I’m aware of four consortia preparing M500 bids. Australia’s PPP contractor Plenary joined forces with Italian civil engineering firm Webuild, French national railways subsidiary Keolis and Japan’s electrical giant Hitachi, as reported by the Irish Independent as early as one year ago. Plenary’s Matthew Biviano moved to Dublin in July to establish the firm’s Irish office, after bringing Sydney’s western airport metro line to the construction phase – a project strikingly similar to MetroLink.

On Tuesday, a new consortium was announced by Spain’s infrastructure contractor FCC, Paris-based developer Meridiam and metro operator RATP, asset manager John Laing, and rail equipment manufacturer Alstom (which already makes Luas trams).

I understand that South Korea’s Hyundai-Rotem, a supplier of trains to Irish Rail, is preparing a bid with rail infrastructure specialist MTR UK and Australian bank Macquarie.

Egis, a French company already active in several Irish PPP concessions and involved in the ongoing Paris metro expansion, is also part of a consortium with partners yet to be revealed.

Canada’s SNC-Lavalin was already contracted to design the MetroLink line as now proposed, via its subsidiary AtkinsRéalis, and is likely to bid for further phases (AtkinsRéalis is currently recruiting a bid writer in Dublin). Other usual suspects such as German train manufacturer Siemens have yet to declare an interest, and probably will.

Many other Irish and international companies interested in various contracts were in the room on Thursday, such as civil engineers Sisk and Bauer, specialist consultancies Ramboll, Systra, and Aureos, as well as the infrastructure teams of big-four professional services firms.

The road is long yet to see MetroLink built, and even longer to achieve this at a sustainable cost. Competition among potential contractors is the most promising sign of this happening yet, in what is otherwise described as a global seller’s market. Keeping the pace of procurement up will be crucial in avoiding a scenario where bidders drop out from frustration, leaving only one, as was the case for the National Broadband Plan.

By tying itself to the mast of this project, the Government is making a bet on Ireland accepting that it can build infrastructure, and industry believing it. The coming year will show how far this commitment goes – for example, whether the ruling coalition has the courage to pass emergency legislation when (not if) a judicial review threatens to derail the project. True political courage, as Colm previously wrote, should also include a commitment to pull the plug if the metro cannot be bought at the right price.

There is much more at stake here than a glorified fast lane to Dublin Airport. It is worth a try.

*****

Elsewhere this week, SMBC Aviation Capital agreed to acquire listed rival lessor Air Lease Corporation in a $7.4 billion (€6.3 billion) cash deal covering $28.2 billion worth of assets. SMBC’s CEO Peter Barrett told Tom that the acquisition would change the industry’s landscape, and Joe analysed it as a seismic transaction rooted in Ireland’s aircraft leasing history.

Also in M&A, Ian interviewed accountants Declan Taite and Myles Kirby as Taite’s Kroll acquired Kirby Healy. They placed the deal in the context of the two firms’ complementary skills and markets.

Following the announcement that the latest prospectus for the issuance of controversial Israeli state bonds had moved from Ireland to Luxembourg, Niall questioned a reluctant Central Bank to tease out the details. As he revealed on Thursday, Ireland remains the formal “home member state” of Isreali sovereign debt issued to EU investors.