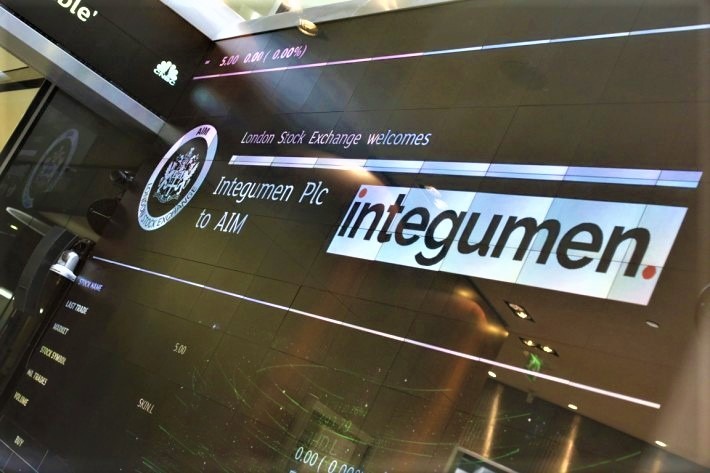

Last year, while browsing on Aim for a target company to reverse-merge his business into, Dubliner Gerry Brandon spotted something interesting. The potential target company was called Integumen. It was a disaster of a business, with the distinction of being the worst-performing Aim flotation in 2017. By mid-2018 it was as good as dead, with a market cap of £1.2 million. Integumen listed as a loose collection of skincare products and lab science. The idea was that some of the skin products were ready for the market, others were still at R&D stage, and that somehow the thing would hang…

Cancel at any time. Are you already a member? Log in here.

Want to read the full story?

Unlock this article – and everything else on The Currency – with an annual membership and receive a free Samsonite Upscape suitcase, retailing at €235, delivered to your door.