The deal was billed as transformational. In a move that gave it a nationwide footprint and bolstered its top line with an additional €11 million revenue stream, the Cara Pharmacy Group closed the deal to snap up Abbey Healthcare in September 2017.

The acquisition of Abbey, which had two retail stores as well as a substantial business supplying outsourced pharmacy services, was part of a wider strategy for Cara’s founders, husband-and-wife team Ramona and Canice Nicholas.

From a single store in Donegal in 2002, the couple had expanded the business to 14 outlets before the Abbey deal, with a growing online platform contributing to overall group revenues of €25 million.

The deal was financed by debt financier DunPort, who advanced €14 million to the business to acquire Abbey and refinance the group’s AIB debt facility. The ultimate plan was to build a chain of 100 outlets across both Ireland and the UK through organic expansion and bolt-on acquisitions. Cara had acquired a number of underperforming standalone shops, but the Abbey deal was a statement of intent.

As the company expanded, so too was the profile of its co-founder. Ramona Nicholas completed two series of the RTÉ Series Dragons’ Den and also appeared on The Secret Millionaire. As the Abbey deal was being finalised, she was shortlisted at the EY Entrepreneur of the Year Awards.

Behind the scenes, however, all was not well – within months of agreeing the finance deal with DunPort, issues were emerging. Confidential court documents obtained by The Currency reveal that DunPort, which advanced the money through a subsidiary called Elm Corporate Credit, began actively engaging with Cara in early 2018 as a result of its trading performance.

By September, just one year after extending the €14 million loan, Cara had defaulted on a number of specified payments due on the facility, although it paid subsequently through a “out of course repayment”. By December, it had been forced to formally restructure the loan.

Even then, the company struggled to hit its deadlines. Documents prepared by an independent expert reveal a catalogue of missed payments, a move that prompted DunPort to appoint KPMG to strategically review the business.

Last week, DunPort ran out of patience and dispatched lawyers to the High Court to seek the appointment of an examiner over the business. With the court granting Cara protection from creditors, Ken Tyrell, a partner with PwC, will now have a window to save the business through a combination of restructuring and cost-cutting.

As part of the application, an Independent Expert Report prepared by Anne O’Dwyer, a managing director with Duff and Phelps, was submitted to the court. Obtained by The Currency, it reveals the true scale of Cara’s financial, woes including a history of creditor default, losses and sluggish growth.

It also reveals how the company is locked in a multi-million battle with the HSE, after it allegedly overclaimed dispensary fees (the company is defending the case).

It also reveals the company’s rental troubles, with one lease of €150,000 per annum on a property owned by Canice Nicholas now valued at just €66,000, as well as its difficulties with key supplier United Drug. The report further discloses that Cara was in talks about a potential sale last year.

Indeed, it outlines how two willing investors have expressed an interest in acquiring the company, or part of it, something that the report states is a positive indication that the company has a reasonable chance of survival.

With documents showing it would leave creditors nursing losses of more than €15 million if it fails to survive, just what went wrong in such a short space of time? And can examiner Ken Tyrell develop a scheme of arrangement to save the chain and the jobs of its 164 employees?

*****

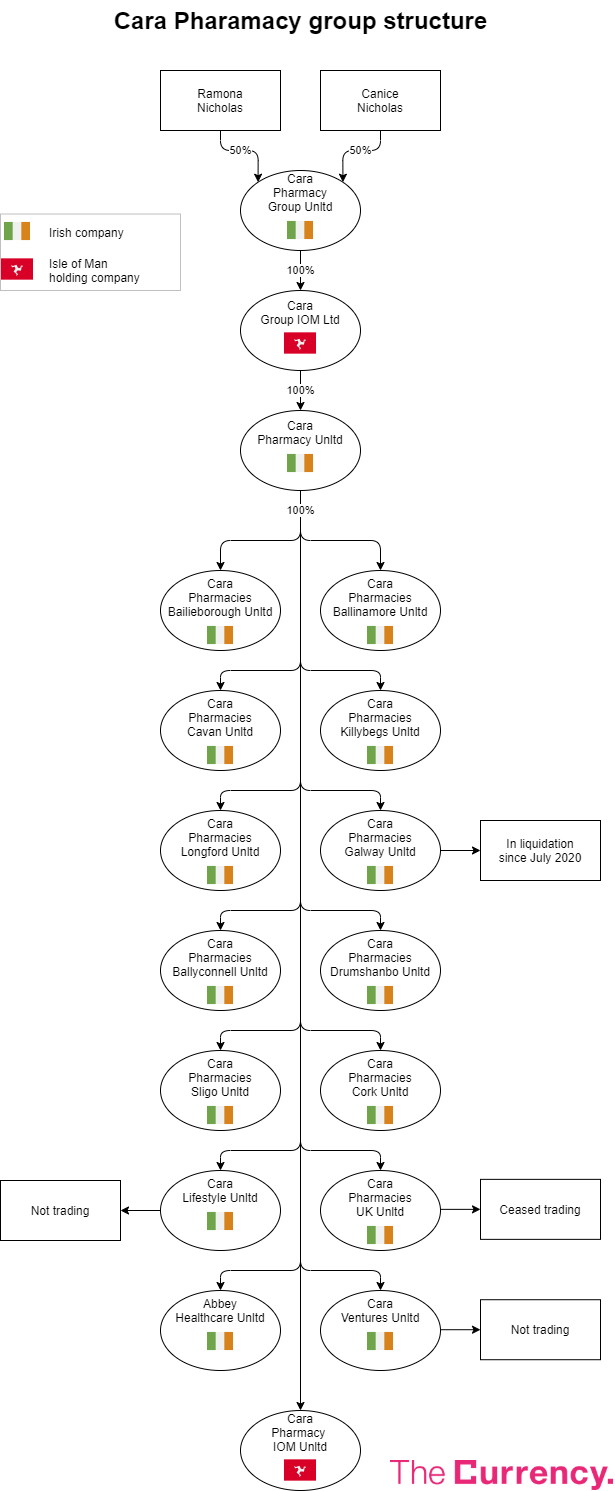

Before you understand the financial difficulties experienced by the group, you have to understand the group structure. And by the standards of most indigenous retail chains, that structure if intricate and complex.

An offshore entity in the Isle of Man, controlled Equally by Canice and Ramona Nicholas, both with addresses in Co Tyrone, sits atop the unwieldy pyramid that links back to a number of Irish holding companies. Each store is then held though a subsidiary entity, which in turn, is incorporated back into the middle tier holding company.

The offshore structure meant there was little visibility on the group’s overall finances, as the Isle of Man entity was not obliged to provide publically available details. However, the expert report prepared by O’Dwyer of Duff and Phelps sheds new light on the strained financial performance of the group, and also reveals how the company benefitted from its siting its headquarters on the border between Northern Ireland (NI) and the Republic of Ireland (RoI).

“The company has historically capitalised on its ability to purchase stock at favourable exchange rates in NI for sale at higher margins in their RoI stores. Whilst the company and the group benefitted from positive exchange rate movement for a number of years, in more recent times the FX market has not been as favourable resulting in pressure on the gross margin and issues around stock management and obsolescence,” according to the O’Dwyer report.

Cara has a heavy focus on retail, transitioning in 2009 after the HSE implemented changes to the state’s Reimbursement schemes. At that point, the mark-up on dispensing fees paid to pharmacies was reduced significantly and the overall amount paid by the State to pharmacists reduced by 30 per cent.

However, retail has also suffered in recent years and the company moved back toward pharmacy services, which, according to O’Dwyer, spurred the acquisition of Abbey in September 2017. Abbey had €11 million in revenues, but 92 per cent of this came from providing pharmacy services to nursing homes, long-term care institutions and hospitals.

As of now, the overall split between healthcare providers and retail across all stores in the group is 70: 30, with the last six months’ trade to June 2020 more weighted towards health and dispensary sales as a result of Covid-19.

However, even before the pandemic, the company was struggling badly. According to the report:

“Consolidated trading across the entire group since 2016 has proven difficult with net losses being incurred year on year which is primarily due to the challenging retail trading environment and deficiencies in respect of costs and stock control. The group has struggled to grow sales within its retail division despite positive headwinds [sic] across the retail pharmacy sector in recent years. Stock management has historically been a significant issue for the group with material year-end adjustments being recorded of c.€500,000 year on year in respect of provisions. Declining sales and increased costs in areas of personnel, administrative and finance costs have put significant pressure on group cashflow with cash reserves significantly depleted in recent years.”

The company had revenues of €23.9 million in 2016 and €26.5 million in 2017. Draft management accounts for 2018 show revenues increased to €33.1 million, partly due to the Abbey deal. Unaudited draft accounts for the 15-month period ending March 2019 show sales of €40 million.

However, things deteriorated with accounts for the 12-month period in 2019 showing sales at just €29.8 million. Draft management accounts for the first six months of the year reveals sales of €11.1 million.

As sales have ebbed and flowed, losses have remained stubborn. A net loss of €319,000 for 2016 increased to €2.4 million in 2017, falling back to €277,000 the following year. Losses for the 15-month period ending March 2019 reached €3 million. This year, losses reached €296,000 for the first six months. In total, the company now has net liabilities of €5.4 million.

“Whilst 2020 has been a very difficult trading period across many sectors it is also important to note that prior to Covid from the beginning of 2020 sales across the group were not meeting budget with Q1 being circa 13 per cent behind budget (12 per cent behind budget for both January and February) and 27 per cent behind 2019,” according to the expert report.

“The impact of Covid in recent months has had a further negative impact on trade as footfall across the group’s stores has reduced significantly with a 22 per cent drop in retail sales evident in the six months to June 2020 on the same period in 2019 (like-for-like basis, excluding discontinued operations).”

A further breakdown is provided of how its divisions have performed during the crisis. In its chain of pharmacies, revenues from its dispensary business are up 10 per cent year on year. However, the retail element of the business is down 10 per cent. The Cara Home division, which is essentially the old Abbey business, is down around 2 per cent.

Overall, the pharmacy chain accounts for around 60 per cent of revenues, with the Cara Home division accounting for 40 per cent. Despite sustained investment, the online presence now accounts for just 1 per cent.

The group has also struggled to meet repayments due to its creditors including its trade suppliers, rents owed to landlords and property rates to various local authorities.

“Changes implemented by its main supplier, United Drug in April 2019, to its payment terms and credit limits has resulted in a negative impact on cashflow. In addition, the Company has an outstanding liability in respect of deferred consideration on the Abbey acquisition of €710k which fell due for payment on 30 June 2020 and currently faces a contingent liability owing to the HSE in respect of a claim that the Group overclaimed dispensary fees in the amount of €2.1m,” according to the O’Dwyer report.

The company has sought to restructure, shuttering stores in Enniskillen, Galway and Kesh. Plans are also being advanced to sell properties for up to €735,000.

Panel: The industry

There has been a raft of mergers and acquisitions in the Irish pharmacy industry in recent years. Uniphar acquired Bradley’s Pharmacy Chain out of examinership in 2018, and last week, the medical supplies business also moved to acquire Ireland’s largest family-owned pharmacy chain, Hickey’s, adding 36 community pharmacies to Uniphar’s existing network, increasing its retail pharmacies to 335. Cardinal Carlyle, meanwhile, acquired the Sam McCauley chain in 2017.

Sales across pharmacies were up 3.3 per cent in 2019 on the prior year and up 1.7 per cent in Q4 2019 compared to the same period in 2018. The impact of Covid in recent months, however, has resulted in a significant increase in costs experienced by pharmacies. According to the Irish Pharmacy Union, reduced footfall in stores has led to a decline in retail sales with many pharmacies experiencing an average 36 per cent decline in sales in recent months.

The report by Anne O’Dwyer says that Cara was also subject to potential takeover action: “The company was previously approached by a reputable third-party pharmacy group in March 2019 in relation to the proposed acquisition of its pharmacy division. The offer was not progressed however, and the process ceased in June 2019. The Company was subject to further discussions with this party in early 2020 however whilst a period of exclusivity was entered into, ultimately the exclusivity was terminated in June 2020.”

Falling margins, sluggish growth and rental woes

The independent report examines both the company’s revenue base, but also its margins. The gross margin for the group was 39 per cent in 2016, falling to 36 per cent in 2017 and has remained broadly consistent at this level. While revenues would appear to have increased, O’Dwyer says this is largely down to acquisitions.

“The signs of recovery in the retail pharmacy sector were evident throughout 2019 with increased sales across pharmacies comparative to 2018. This, however, was not reflected in the performance of the Cara Pharmacy division which continued to perform behind 2018,” the report states.

“Sales across the Cara stores to December 2019 were 15.6 per cent behind that in December 2018. The fall in the group gross margin also appears to be largely impacted by the Abbey acquisition which completed on 8 September 2017.”

However, despite falling margins and sluggish growth, costs remained stubborn, with overheads stagnant at €10.5 million. In 2019, exceptional items totalled €541,000, and interest costs hit €1.2 million. There are significant issues in relation to stock management, particularly slow-moving stock such as fragrance and dispensary products.

“The group does not operate an integrated stock management system. I have been advised by the petitioner that material year-end adjustments are being recorded year on year in respect of stock provisions (c.€500,000),” according to O’Dwyer.

O’Dwyer notes that a number of synergies highlighted by management were not achieved in terms of stock management and cost savings related to personnel were also slow to be achieved. However, the Cara Homes division continues to show signs of improved trade and profitability, with overall sales decline being driven by the pharmacy division.

Rents are one of the key parts of the “cost base to be addressed” during the examinership, according to the expert report. Cara Pharmacy’s strategy to increase its number of stores, including through the acquisition of Abbey Healthcare, resulted in annual spending of €1 million on rents alone.

“There are a number of lease agreements that were entered into at the peak of the market between 2004 and 2008. In addition, these leases have upward-only rent review clauses,” the report notes. For example, the stores in Co Leitrim and on Wine St in Sligo were leased in 2004 and 2005 for 25 to 35 years with upward-only clauses. “Floor area and estimated rental values are not available for these properties but it appears likely that these properties are over-rented and therefore are of no capital value.”

In the past 14 months, the group exited some of its costliest leases by closing down its Galway and Enniskillen stores. Galway was its most expensive location, costing €200,000 per annum, while the Co Fermanagh store had an annual rent of €83,592.

“Residual contracted rents in respect of the Galway and Enniskillen stores are estimated at €607,000. I understand from the petitioner that settlement agreements have been negotiated by the company with both landlords in respect of these tenancies and have subsequently been paid,” the independent expert reported. As the Galway subsidiary has gone into liquidation and surrendered its lease, no further amounts appear for these leases in the statement of affairs.

The highest rent currently being paid by Cara Pharmacy is for its store in Sligo’s Quayside shopping centre. “An opinion on valuation of properties commissioned in February 2018 highlighted the market rent of the property in Quayside, which is let from group director Canice Nicholas, to be €66,600 which confirms that this unit in particular is significantly overrented at €150,000 per annum,” the report highlights.

The group now stands to pay €735,000 in rent each year on its existing retail footprint. It also owns two of its own stores in Bundoran and Bailieborough and a warehouse in Ballyshannon, Co Donegal, as well as two investment properties in Cork and Kesh, Co Fermanagh. Cara Pharmacy has put the warehouse and the two investment properties up for sale. The independent expert reported that the warehouse was sale agreed at €400,000 earlier this year, but Covid-19 has delayed closing the transaction. Meanwhile, the Cork investment property is sale agreed at €235,000 and the one in Kesh is on the market for €100,000.

Dunport, United Drug and the HSE

The company lost €296,000 in the first six months of this year. However, were it not for the Wage Subsidy Scheme, the number would have been far larger – it received state support of €471,000 in that period.

However, the bigger issues lie with its main creditors and suppliers, and this is something O’Dwyer zones in on in her forensically prepared report.

The report outlines the series of missed repayment deadlines to DunPort over its €14 million debt such as a €200,000 payment due on June 30, 12020 that was paid on August 17. However, it also outlines that the company owes other creditors €5.27 million, including a remaining €710,000 in respect of deferred payment on the Abbey acquisition.

Its largest trade creditor and key supplier is United Drug, who accounts for approximately €1.55 million or 43 per cent of the group trade creditor balance. The company has been engaged with United Drug on its issues for some time, the report reveals.

The report adds:

“The company entered into a trading agreement with United Drug in April 2019 in respect of overdue trade debts amounting to €586,000. The agreement put in place strict credit limits, the removal of future date orders and payment terms. The agreement was amended in June 2019 to provide for additional credit limits of €330,000 to alleviate cash pressure points.

“The agreement expired in April 2020 at which point all credit terms with United Drug were to be reduced to 30 days. I understand from the petitioner that the company has recently engaged with United Drug in respect of outstanding liabilities and have agreed a settlement payment in respect of aged balances greater than 60 days (i.e. 70 per cent of aged balances / €586,000 in full and final settlement) with all other current balances to be paid within 30 days. I further understand that the payment of this settlement remains outstanding.”

In addition, Cara currently faces a contingent liability in respect of a legal action taken by HSE against the group in 2017 regarding payment of €2.1 million in dispensing fees. The HSE alleges the company overclaimed fees between 2011 and 2017. O’Dwyer says the claim against the company is part of a much wider investigation by the HSE into a number of pharmacies suspected by the HSE to have overclaimed for prescription charges.

“One such case, taken by the HSE against Hickeys Pharmacy Group in February 2019, was reportedly settled out of court. The directors have engaged legal advisors to defend the claim on their behalf and I understand they intend to fight the claim,” according to the accountant.

Summing up the company’s overall issues, O’Dwyer writes:

“The challenging economic environment in which the Company and Group operates has led to falling sales, reduced margins and rising costs which has been exacerbated by a loss of footfall in store locations, the impacts of changing consumer trends and preferences particularly in respect of beauty purchases, cuts to dispensary and disbursement rates by the HSE and stiff competition from larger pharmacy groups consolidating market share in the industry.

“The strategy to increase the portfolio of stores to 16 resulted in a significant debt burden on the company with finance charges of €1.2m per annum, €1m per annum for rent (before recent store closures), €253,000 for service charges and rates with significant capital investment being made in stores.”

The rescue plan and future projections

To help the process, the company’s management have prepared trading projections for the 21 months to March 2022. The figures are prepared on a going concern basis assuming the continuing trade of its 13 stores and assumes all current lease terms remain in place.

Revenue performance to December 2020 is forecast to be 22 per cent below that in achieved to December 2019, driven by declines in retail of 36 per cent and care home of 17 per cent followed by a decline in dispensary sales of 15 per cent. Management have forecast flat retail sales across all stores for most of Q3 and Q4 2020 based on average actual performance for Q1 and Q2, with increases of 30 per cent forecast across all stores in November and December 2020 and in 2021.

Based on these numbers, and without changes in rents or operations, the company will lose €193,000 this year and a further €889,000 next year.

As such, O’Dwyer concludes that the business needs to be restricted under examinership if it is to have a reasonable chance or survival. She identifies a number of key components of any scheme including:

- A full review of all property-related costs on a store by store basis;

- A full review of non-trading overheads including subscriptions;

- A review of related-party lease obligations;

- Agreeing to a restructure of leases where rents are significantly in excess of market levels;

- Review of the stock management system to ensure accurate and recoverable balances being carried;

- Review of systems and financial controls to ensure robust working capital management going forward;

- A review of the existing management team to ensure the business is well placed to move forward post-examinership process;

- Review and restructure of the debt facilities in advance of their expiry, and;

- Investment from a third party to fund the scheme of arrangement.

According to the report: “In addition, Elm [the Dunport subsidiary] will provide funding support for the ongoing operations of the business throughout the examinership process. On this basis trading activities are not anticipated to be adversely impacted from a funding perspective.”

The stakes are high. If the company goes bust, the group will leave behind debts of €16.3 million and more than 160 people without jobs.

Tyrell, an experienced insolvency practitioner with PwC, has 100 days to prevent this from happening.