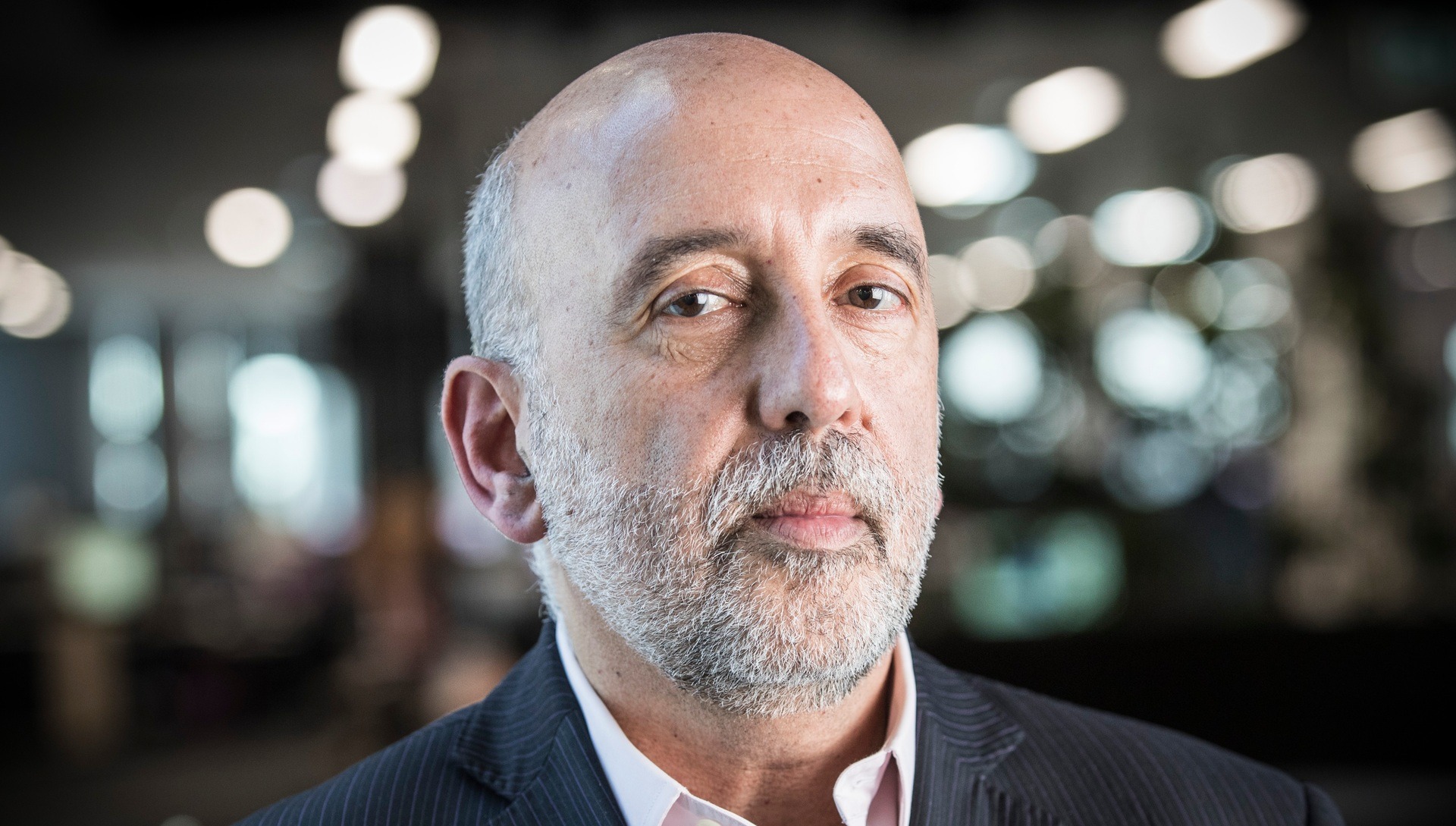

Since the crisis began last March, precipitating an inexorable, yet painful, wave of shutdowns and restrictions, Gabriel Makhlouf has been assessing the various economic data streams that are available to the Governor of the Central Bank of Ireland. And one thing has struck Makhlouf deeply: the juxtaposition between the macro and the micro. The Irish economy, and the tax take that flows from it, both showed remarkable resilience in 2020. In GDP terms, admittedly a number skewed by the high volume of pharmaceutical and technology multinationals operating here, Ireland was the best performer in the world last year. And, as…

Cancel at any time. Are you already a member? Log in here.

Want to continue reading?

Introductory offer: Sign up today and pay €200 for an annual membership, a saving of €50.