When it comes to IT multinationals, Oracle is a discreet giant. You won’t see its logo pop up on your screen unless your work involves diving into the entrails of the cloud. And while it easily ranks among the ten US tech firms with the largest business based in Ireland, its Dublin operations display none of the towering architectural ostentation on show at Google or Facebook’s HQs in the Silicon Docks, or on Microsoft’s Sandyford campus.

Instead, Oracle is nestled in the low-key East Point business park next to Dublin Port, where it owns an office complex that doesn’t look remarkable from the outside but was internally refitted to the highest standards in 2018.

At the time, the historic Silicon Valley database company turned Texas-headquartered cloud infrastructure provider ran its international business through a well-established double Irish structure. A cascade of subsidiaries around Europe, the Middle East and Africa trickled revenue up to intermediary Irish holding companies under the form of licensing fees for the group’s technology.

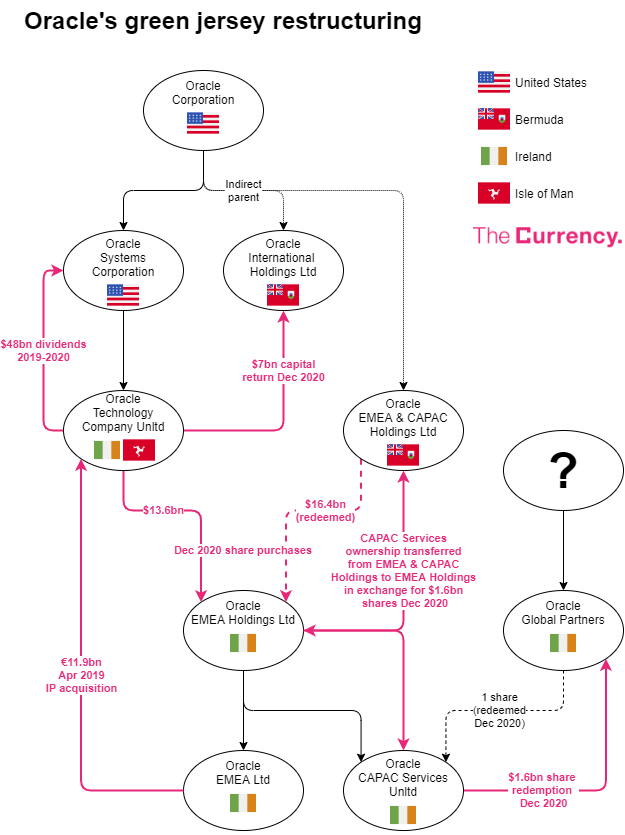

Profits were concentrated in Oracle Technology Company Unltd, an Irish-registered company domiciled in the Isle of Man where it owned intellectual property rights for regions managed through the Dublin office. Oracle Technology Company Unltd made a $17 billion profit in 2019 but declared “no tax liability in Ireland or in any other jurisdiction” – instead parking years of accumulated profits in the Isle of Man until a favourable US tax break offered an opportunity to repatriate them home. The same structure applied to businesses acquired by Oracle, such as hospitality software provider Micros Fidelio.

Less than three years ago, Oracle Technology Company Unltd had $44 billion in net assets. New filings show that it has now been largely gutted, while the East Point office consolidated its central position in Oracle’s global empire – though they also reveal that the group has not fully given up on using zero-tax jurisdictions elsewhere.

Up to $50 billion in dividends

Tax reforms in the US and in Ireland triggered the switch to the green jersey structure adopted by many other IT giants. Since former US President Donald Trump introduced a reduced tax rate on deemed repatriated offshore profits at the end of 2017, Oracle Technology Company Unltd has paid around $50 billion in dividends to its US parents, combining existing cash reserves, continuing profits and the realisation of other assets.

Meanwhile, as Ireland had announced a ban on double Irish tax arrangements from 2020, Oracle Technology Company Unltd sold its intellectual property to its fully Irish-based indirect subsidiary Oracle EMEA Ltd for €11.9 billion in April 2019, as previously reported. These intangible assets were amortised and did not contribute any significant value to the balance sheet of the transferring company, yet it booked a $12.2 billion profit when it sold them to its Irish subsidiary.

Profits generated from the corresponding licensing fees are now earned in Dublin, where IP assets are amortised and intercompany debt interest offset against them under Irish tax law.

Documents filed in recent days show that the Isle of Man-resident company re-injected a cash sum equivalent to the proceeds of that sale to Dublin early last December, purchasing $13.6 billion worth of shares in Oracle EMEA Holdings Ltd – another Irish company that is now emerging as the central point of the group’s non-US business.

Not only is Oracle EMEA Holdings Ltd the parent company of Oracle EMEA Ltd, its main trading unit (and now IP centre) in Ireland with €7.4 billion in annual revenue and over 1,400 employees. For years, it has also owned over 60 subsidiaries generating sales from Portugal to South Africa and Russia, and this role is now expanding.

Canada, Latin America, Asia move to Ireland

Another Irish company, Oracle CAPAC Services Unltd, has been collecting similar licensing fees with help from over 50 marketing subsidiaries around the Pacific ocean from Canada to Japan, bringing in $4.3 billion in annual revenue. It had 569 employees last year. Together, Oracle’s Irish-based EMEA and CAPAC units account for the vast bulk of the group’s turnover outside the US.

Until recently, Oracle CAPAC Services Unltd was owned by a Bermuda group company, Oracle EMEA & CAPAC Holdings Ltd – except for one share held in succession by two so-called general partnerships. This share, previously owned by Oracle OTC Holdings General Partnership in the US state of Delaware, was transferred to Oracle Global Partners last October. As a general partnership based in Ireland (its address is that of Dublin law firm Matheson), Oracle Global Partners is not required to disclose any financial information. Its members are unknown and is not even registered with the Companies Registration Office. This is the most opaque business form available under Irish law.

In mid-December, a series of multi-billion dollar transactions saw the consolidation of this business within Ireland.

On December 14, the Bermuda company transferred ownership of Oracle CAPAC Services Unltd to Dublin-based Oracle EMEA Holdings for $1.6 billion, in exchange for a share subscription in the same amount. In parallel to this straight share swap, however, more was happening with the Pacific Rim-focused company.

On the same day, the Bermuda company also injected the exact same sum in cash into Oracle CAPAC Services through the subscription of new shares. This amount was immediately distributed to its other shareholder by way of an equivalent reduction in Oracle CAPAC Services Unltd’s capital: “The Company redeemed and cancelled the shares held by Oracle Global Partners in the Company for an aggregate redemption price of US$1,611,120,135,” it reported last week. As detailed above, Oracle Global Partners is an Irish general partnership and no information is available on what it did with this $1.6 billion.

Again on December 14, Oracle EMEA & CAPAC Holdings Ltd acquired a further shareholding in Oracle EMEA Holdings Ltd, this time injecting $16.4 billion in cash. However, the new shares were immediately redeemed and it appears the funds did not really leave Bermuda, instead appearing only temporarily in the Irish company’s capital account.

This latest filing brought the total capital transactions through Oracle’s Irish office that month to over $30 billion.

A few days later, the group continued to hollow out its former double Irish, Manx-resident unit. On December 17, Oracle Technology Company Unltd conducted two share capital reductions and returned proceeds totalling $7 billion to another Bermuda intermediary, Oracle International Holdings Ltd.

While it will take until the end of next year before accounts filed in Ireland show the full impact of the new structure, this much is clear: any profits made by Oracle outside the US are now fully centralised in Ireland, where they are calculated against technology costs also located here through intellectual property transfers. Future results will show how much of these profits contribute to the Irish Exchequer – until recently, Oracle paid little corporation tax here, with accounts showing that taxes paid by its Pacific region-focused, Irish-based trading company mostly went to the countries where it did business. Meanwhile, its Dublin-based European operation was loss-making, transferring all income to its Isle of Man-resident parent.

In the meantime, recent filings show that Bermuda continues to act as a buffer for repatriations that trickle up from Dublin towards the group’s ultimate US base.