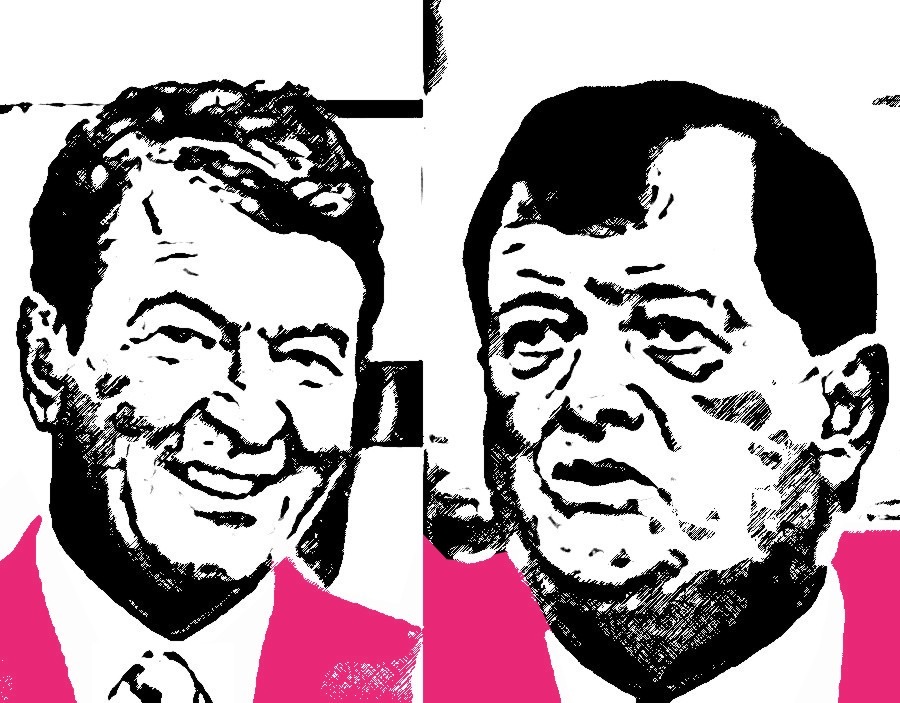

A minority shareholder in the Davy Hickey group has failed to halt the sale of up to €40 million in development assets at Citywest. Fulman Holdings, an investment group led by former Davy stockbroker and Goldman Sachs executive David Shubotham and billionaire Ardagh chairman Paul Coulson, had sought a temporary freezing order stopping the disposal of company assets until its oppression lawsuit against the board of Oviedo, an offshoot of Davy Hickey Properties (DHP), is decided. The Commercial Court refused the injunction application as a pause on sales could negatively affect the majority of company shareholders, who support the board’s strategy,…

Cancel at any time. Are you already a member? Log in here.

Want to read the full story?

Unlock this article – and everything else on The Currency – with an annual membership and receive a free Samsonite Upscape suitcase, retailing at €235, delivered to your door.