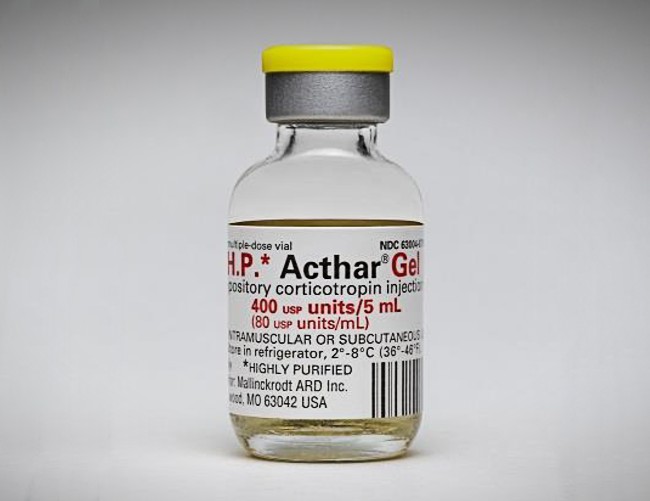

On Tuesday, in a federal bankruptcy court in the US state of Delaware, Judge John Dorsey heard the final arguments of a lengthy case over the chapter 11 reorganisation plan for Mallinckrodt, the pharmaceutical giant. The debt restructuring plan is designed to allow the company to shed as much as $1.3 billion in debt and to deal with lawsuits claiming it profited from America’s opioid epidemic by making a $1.7 billion settlement. It has not been an easy process. Rhode Island, for example, has opposed the settlement, arguing that the deal would shield the company’s executives from opioid litigation. The…

Cancel at any time. Are you already a member? Log in here.

Want to read the full story?

Unlock this article – and everything else on The Currency – with an annual membership and receive a free Samsonite Upscape suitcase, retailing at €235, delivered to your door.