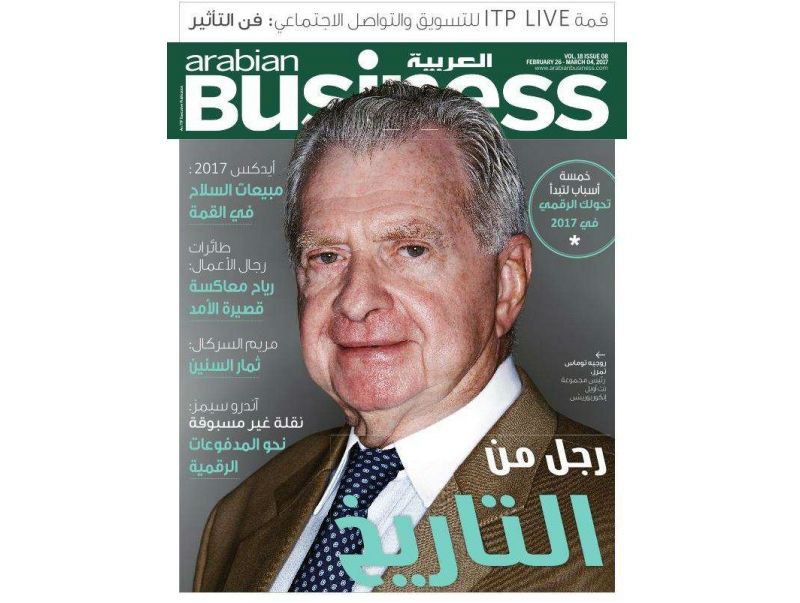

The deal was meant to lead a small Irish oil exploration company to potentially lucrative new oil fields in high-risk Iraq and Libya. Instead, a reverse takeover by investors surrounding a high-profile Lebanese-American businessman is now at the centre of a legal battle. Dublin-based oil exploration company Petrel Resources PLC said it secured a High Court injunction this Friday against the overseas investors taking part in an ongoing process to take over a majority stake in the company. Court records show that Petrel is represented by McEvoy Corporate Law in a case against Roger Edward Tamraz, Michel Fayad, Said Mehraik…

Cancel at any time. Are you already a member? Log in here.

Want to read the full story?

Unlock this article – and everything else on The Currency – with an annual membership and receive a free Samsonite Upscape suitcase, retailing at €235, delivered to your door.