Pret A Manger’s announcement this week that will open 20 outlets in Ireland north and south in the next decade acknowledged the crucial role to be played by Carebrook Partnership Ltd, the franchisee selected to operate the Irish locations.

The new Irish company was established last October by Gerard Loughran and Ray McNamara. Its latest filing on February 22 showed that it is based at the head office of McNamara’s Irish cafe chain Ann’s Bakery in its historic Dublin address on Mary St, where the business started in 1974.

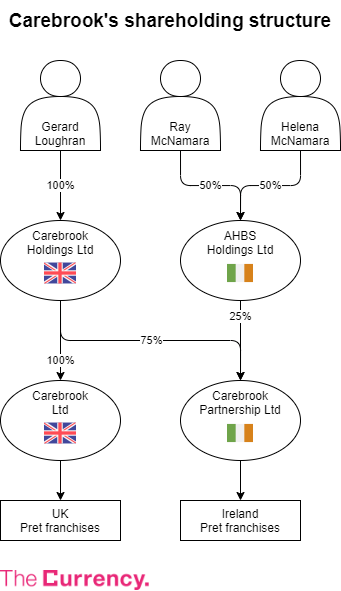

The McNamaras own 25 per cent of the Carebrook Partnership through their company AHBS Holdings. Loughran holds the majority 75 per cent shareholding through his UK vehicle Carebrook Holdings, which in turn owns his main trading company Carebrook Ltd and other subsidiaries operating Pret locations in Britain.

Accounts filed by the shareholders give a glimpse of the resources at their disposal to roll out the chain in Ireland, starting with an initial shop announced for Dublin’s Dawson St this summer.

Loughran’s Carebrook group holds significant firepower. On March 31, 2021, as it closed a financial year coinciding with the worst of Covid-19 lockdowns, Carebrook Holdings and its subsidiaries had £10 million in net assets, including £4.9 million in cash.

This came partly from the past profits of its Pret franchises, which Loughran has been growing for three decades. In 2020, he reorganised various subsidiaries under the new holding company. In the process, his main trading entity in Britain, Carebrook Ltd, paid a £7.4 million dividend which in turn fuelled a £9.5 million capital injection into Carebrook Holdings.

The holding company also owns £18.5 million worth of investment properties, according to their valuation on the occasion of the group restructuring in 2020. Company documents suggest that the assets are a mixture of Pret A Manger locations and properties rented out to other retail tenants.

For example, Carebrook Holdings has mortgaged two freehold buildings at opposite ends of London’s Camden High St – one home to an outlet of the sandwich chain and another let to a shoe shop. Pret cafes in other locations, meanwhile, are reported as leaseholds.

Against these substantial assets, Carebrook Holdings and its subsidiaries owed a total of £10 million in bank debt.

Carebrook navigated the pandemic remarkably well. Although the revenue of its main trading subsidiary fell by 40 per cent to under £7 million in financial year 2021, it cust cost and collected £1.3 million in government grants, limiting losses to just over £230,000. Consolidated group accounts showed a pre-tax profit of £1.1 million and Carebrook Holdings paid Loughran a £125,000 dividend that year.

Filings show that he has had Ireland in his sights for three years. Loughran first incorporated a British company called Carebrook (Holdings) Ireland in May 2019 and gave it an Irish subsidiary in Swords, Co Dublin under the Carebrook Ireland name five months later. He later gave up this structure in favour of the partnership with Ray McNamara and those companies no longer exist.

€2.5m worth of property at Ann’s Bakery

McNamara, meanwhile, had not yet placed any capital in AHBS Holdings when it last filed accounts for 2020. He did, however, have reserves elsewhere in companies associated with Ann’s Bakery.

Annette’s Hot Bread Shops Ltd, which has owned properties used by the chain in several Dublin locations, was sitting on €1.3 million in retained earnings at the end of December 2020. While it had no significant cash reserves, its property portfolio was valued at €2.5 million, far outweighing bank debt of €1 million.

The two partners’s similar business models give a clue as to the strategy they are likely to adopt when bringing Pret A Manger to Ireland. They have cash available, as well as properties available both to raise debt against and to convert to the popular British brand if they decided to replace existing Ann’s Bakery locations.

They can be expected to look for a combination of leases and outright purchases of properties to open new Pret outlets, which has served them well in the past – especially during lockdowns, when other retailers and hospitality businesses were battling demands from landlords.

This prudent approach, more capital-intensive than a blitz on empty rental units available across post-Covid Ireland, may explain why the plan Pret A Manger announced this week is for just two openings per year across the island of Ireland – a modest pace for a global chain with around 550 existing outlets.