Late last week, Rosanna sat down with Leo Varadkar, the Tánaiste and Minister for Enterprise, Trade and Employment. The interview, published today, is wide-ranging, insightful, and, at times, provocative.

Varadkar covers a lot of ground, outlining his views on everything from the Barryroe oil field to his legacy across various ministerial portfolios. He explains why the British government is not making decisions on what is best for the North or for the British economy and argues that data centres are now effectively a requirement of continued multinational investment here.

He also talks about energy security, Enterprise Ireland, and Ireland’s start-up ecosystem, while giving some clues about how the government intends to reform the KEEP share option scheme and the capital gains tax regime.

A particularly interesting segment was his views on inflation. Yes, it is a concern for the Fine Gael leader. But he is more concerned about the paradox of thrift and talks about what the government must do to avoid a downward spiral over the current cost of living crisis.

“There is a lot of people who are struggling to make ends meet, wondering how they are going to pay the bills. and making difficult choices as to what they spend money on, and at the same time, one in four of every euro earned in Ireland is being saved, because people who do have money are now afraid to spend and invest – and we need to avoid getting into that spiral,” Varadkar told Rosanna.

As I read the interview, it was impossible not to think of our recent series by Stephen Kinsella. Over four weeks, and close to 8,000 words, Stephen delved deep into Ireland’s generational gap – in housing, in education, and more. It was a sobering series, highlighting many of the issues that we talk about every day without ever drawing them all together.

Leo Varadkar is right to be bullish about so much. Ireland in 2022 is a far better place that it was twenty or thirty years ago. This is the most educated generation of Irish people we’ve ever produced. It has access to more information than any generation before it. This generation is armed with the latest technology and the latest ideas.

Yet, as Stephen explored methodically over the course of his series, young people today are increasingly locked out of the system. Ireland was poorer back in the 1980s, but people could afford the trappings of a middle-class lifestyle – a house, a car, a holiday – on a median income. This is no longer the case.

Stephen drew four themes from his series. First, millennials are taxed more than their parents and grandparents, paid less in real terms, and get a smaller share of their output. Secondly, this cohort, like all cohorts, is aging, and the policy problem of the coming decades will be what to do with a large group of assetless older people.

Thirdly, monetary policy across the world over the last decade or so has worked to increase the value of all assets including housing. Meanwhile, rental supports end up just ensuring stable returns for international investors over decades. The result is a divergence in the distribution of wealth.

The final point, one that Stephen describes as “the issue to end all issues” is climate change. “Absent some technological miracle, there are only two options — accommodative monetary policy led by central banks, or higher taxes on more people working for longer. Neither option is being discussed actively as a public,” he argued.

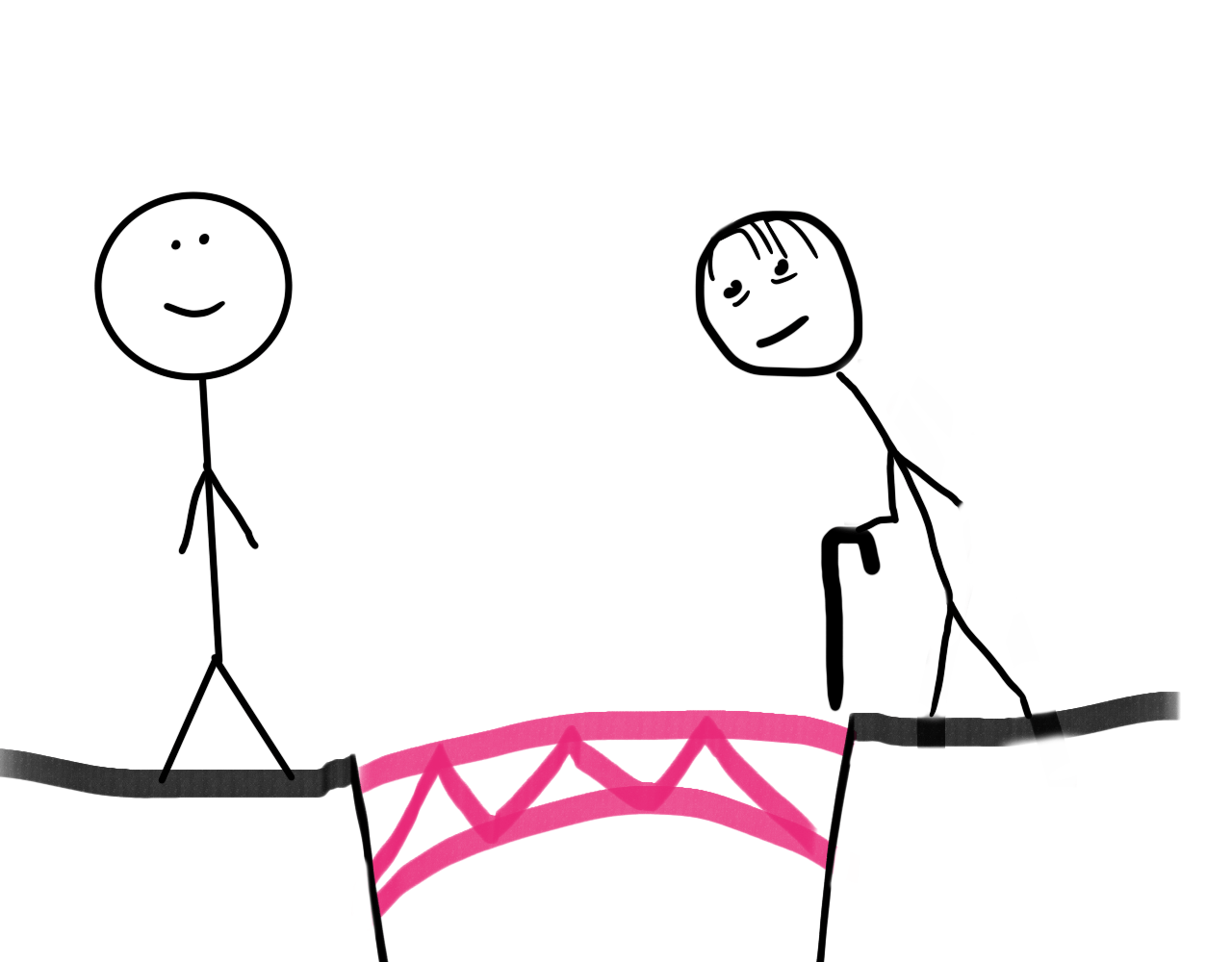

So, what can we do to bridge the growing generational divide? This was something Stephen discussed in his final column last week. He wrote about the need for more housing, designed for smaller family units, and the role of the state in cost rental schemes. He also argued that the pension systems need to change, and, if not, retirement ages will have to rise.

But, finally, and most unpopularly, he talked about the role of taxation:

“Aging is a fact. Housing needs are a fact. Health needs are a fact. Climate change is a fact. These facts must be paid for. Ireland’s massively progressive tax system is a key feature of our democracy, but taxing workers and firms a bit more at both higher and lower points in the income distribution will be necessary. I note the exact opposite is being discussed in the media at the moment.”

These are themes that will continue to explore and discuss because they are fundamentally so important to what sort of country and society we aspire to. Far too often, we get caught up in the moment, and forget to take a step back at the macro picture. It is why we invest so little in long-term capital spending, and why we fail to address long-term structural issues within both society and the economy.

*****

I have long been intrigued and impressed by Terry Clune. He is among the greatest Irish entrepreneurs and business figures of his generation but is rarely discussed in such terms. Yet what he has achieved with his portfolio of technology businesses is outstanding. I interviewed him 15 years ago, and he told me that he kept a file with all his various business ideas. The amazing thing is on how many of them he has followed through. He sat down with Rosanna last week, and the result is an amazing portrait of an entrepreneur. In the in-depth interview, he discusses a potential IPO of his unicorn TransferMate, the bitter dispute with IDA Ireland over Connect Ireland, and a car accident that almost killed him.

Act Venture Capital, the early-stage to series A venture capital firm, closed its sixth fund last week. With €140 million to invest, its managing partner John Flynn explained to Tom how it sees the tech market and revealed its plans to invest between €100,000 and €10 million in 35 start-ups.

From eschewing lucrative debt collection work to spinning off legaltech companies, Leman Solicitors has always followed its own path. Having just merged with international law firm Ogier, co-founder John Hogan reflected on the firm’s origins, its expansion, and its future.

Aislinn McBride is one of the most senior technology leaders at Kainos. As the Belfast software group’s international expansion pushes revenues past £300 million, she openly discussed its next challenges with Thomas: finding and keeping staff, fending off cyber-attacks and exploring the ethics of AI.

Total Produce’s merger with Dole looked to have been a master stroke, timed as it was at the peak of the bull market. But since then, anything that could go wrong has gone wrong. Last week, Sean asked: Is there value in Dole shares?

Sinead also wrote a column on why she rejects the concept of Botox as a service. “My body, my face and my features are highly imperfect. And as expensive as it is, unfortunately, the price of perfecting my attributes is more than just financial,” she wrote in a thought-provoking column.