As bad as this week has been for the Twitter staff, there might be worse to come.

Musk has already slashed headcount in half and started meddling with the product. But, as I wrote this week, he is a man under pressure. He needs to find a way to squeeze cash out of the organisation, post haste.

He’s in a hurry because he financed his takeover in part with $13 billion of debt. The debt doesn’t come cheap: Bloomberg forecasts the interest will come to $1.2 billion per year, with the potential to rise further should rates go up.

Bank debt is no joke. If Twitter fails to make its interest payments, the creditors could potentially enforce against Musk and the other owners. The bankers could end up owning Twitter.

How much is $1.2 billion in the scheme of things?

Here’s Twitter’s 2021 income statement. You read the chart from left to right. On the left are its sources of revenue; then its variable costs; then its fixed costs; then interest (which in 2021 was actually positive), and finally its net profit.

It’s a useful chart for seeing the broad outlines of Twitter’s business and its costs. But what we’re interested in is specifically this $1.2 billion interest bill.

For that, I’ll use the following chart of Twitter cash flows — because you can’t pay an interest bill with an accounting profit. Banks only want cash.

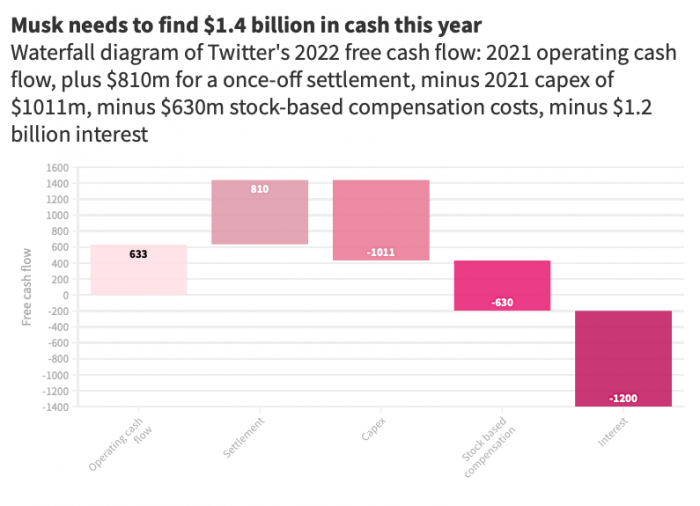

The chart below is a waterfall diagram. It goes from left to right. It begins at zero, and each bar either adds to or detracts from the bar to its left. What it shows is that Twitter has to find an additional $1.4 billion of savings in order to stand still.

Last year Twitter’s operations generated $633 million in cash. Last year however the company was hit with $810 million of exceptional charges, which it won’t have to pay next year. I’m adding those back in. Then I’m subtracting last year’s capital expenditure (ie, investments in new equipment and such) of $1,011 million. Then I’m subtracting $630 million in stock-based compensation. As Ben Thompson pointed out, Twitter staff have, to now, been paid partly in stock. From now on, they will have to be paid in cash. Finally, there’s the new interest bill of $1.2 billion. This all nets out at $1.398 billion: the amount of cash Musk is going to have to come up with this year to keep the banks at bay.

Option 1: Slash costs

This is well underway. In his first week, Musk has already fired half the staff.

To this point, Twitter has not been in a hurry to cut costs. In the eleven years since it went public, it has lost $1 billion. In that time its total number of employees has gone from 400 to 7,500.

Twitter has a reputation for having a gentle culture. Facebook product manager Antonio Garcia Martinez called Twitter: “Shambolic hipsters with the expensively decorated offices, thousand dollar fixies in their bike stand, and the fail whale [the message seen by users during Twitter’s not-infrequent site outages].”

Clearly, Twitter is smaller than Alphabet, Meta and Apple. But even on a per-employee basis, it takes in less revenue and profit than those companies.

Having spent the last two years hoarding talent, suddenly the new consensus is that the technology industry is overstaffed. Twitter is about to find out whether or not that is true.

Option 2: Invest less

Then there's Twitter's Capex spend. Capex is money companies invest in future capabilities by buying assets. Twitter spent $1 billion on Capex in 2021. Then there's R&D, which is basically the same as Capex, but treated differently by accountants for some reason. Twitter's R&D and Capex budgets are both very big: it spends proportionately more on both R&D and Capex than any of its peers.

Cutting Twitter's investment back to the level of peers — ie cutting it in half — would save about $1.1 billion. That's a good start.

Option 3: Charge for ticks

Twitter is currently free for users and makes its money on ads. Musk says that's not going to cut it. He wants to start charging for blue ticks.

How much might the blue ticks bring in? If I generously say five per cent of Twitter's daily users sign up, that's about 12 million people. 12 million times $8 per month brings in $1.15 billion per year.

Musk's blue tick plan seems to suggest paid-up blue tickers will get more engagement on their tweets. This risks messing up the experience of the 95 per cent — why tweet something if people can't read it? And risks undermining Twitter's advertising business which, at $4.5 billion in 2021, is essential to keeping Twitter going.

Option 4: Charge everyone

A different tack might be to charge everyone. Twitter doesn't have as many users as Facebook but they are quite highly addicted. Might they be persuaded to pay for access? Would they pay $5 a month?

Let’s say he tried to charge $5 per month for access. If say one-quarter of Twitter's 280 million monetisable daily users signed up for $5 per month, that'd bring in $4.2 billion.

But the paid-up Twitter users would probably expect no ads in their feed, and the ad market would be 75 per cent smaller in any case, so charging for access would mean jettisoning the $4.5 billion ad business. I don’t see how charging for access could be made to work.

Option 5: Muddle through

This option is I think underrated. Yes, Twitter dossed around for the last ten years. But its advertising business has actually been growing well in recent times. They seem to be getting better at it.

To be sure, the technology industry had an exceptionally strong 2019-2021. But the chart below is encouraging. If it can keep up anything close to that trajectory, it'll solve a lot of problems.

The question is whether the growth of the advertising business would continue given Musk's tinkering with the product, and his dreadful PR skills, and the very high chance of mass layoffs and deep cuts to its internal investment budget.