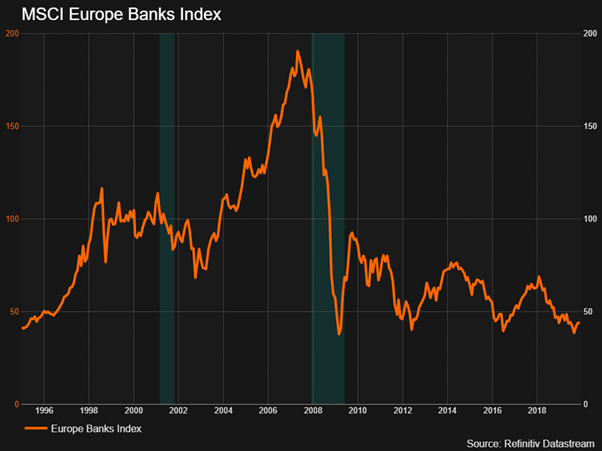

Bank shareholders are having a hard time. Squeezed margins and weighty regulation have dampened profit and potential for traditional banks around the globe. For many banks, the absolute and relative decline in their share prices has followed inexorably. In contrast to buoyant stock-markets more generally, the index of European bank shares for example, recently touched a 30-year low. Some argue that bank shares are now ‘cheap’ and represent an attractive investment opportunity. In many cases trading below the balance sheet valuation of their equity, they argue that even a modest improvement in business performance would spark a sharp rebound in…

Cancel at any time. Are you already a member? Log in here.

Want to read the full story?

Unlock this article – and everything else on The Currency – with an annual membership and receive a free Samsonite Upscape suitcase, retailing at €235, delivered to your door.