Market signals tend to be unreliable guides to the future. That’s because any time they show a consistent pattern, traders get wind of it, and start trading on that basis, and the pattern goes away. Market signals are a moveable feast.

An exception to this is the inverted yield curve. Since the 1980s, every time US government bond yields have inverted (more on what this means shortly), the economy has crashed a month or two later.

When bond yields look like they’re about to invert, people get very nervous. And US yield curves are very close to inverting as I type.

We’re talking about US government bond investors here. They’re important even to Ireland because the US sets the pace for the global economy. It’s rare for the US to slow down and not drag the global economy down with it.

Coupons and curves

A yield curve shows how the market is pricing bonds of different maturities. But first — what’s a bond? A bond is a promise to repay a sum of money, plus an annual coupon, at a date in the future. Bonds are usually issued with maturities of between one and ten years.

All things being equal, a one-year bond is safer than a ten-year bond. Because anything could happen in ten years. The government could go bust, or inflation could wipe out the purchasing power of money.

So short-term bonds tend to trade at a higher price than long term ones. This means that short-term bonds have a lower yield than long term ones, since yield is the relationship between the market price of the bond and the guaranteed stream of income it represents. If lots of people want to buy a bond its price goes up, causing its yield to go down.

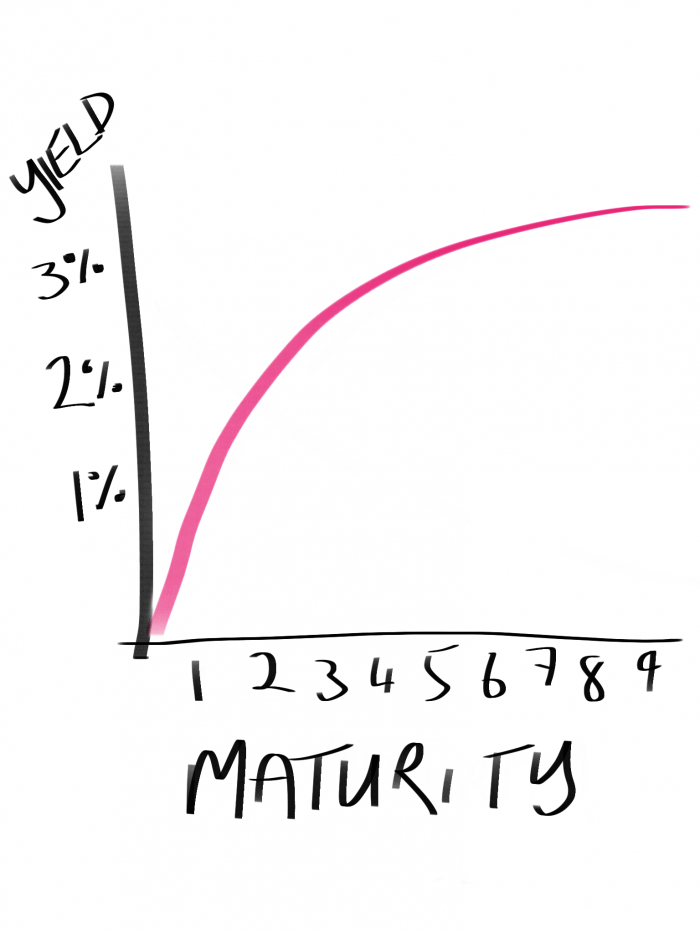

The following chart shows a normal yield curve. Short-term bonds are safer and more valuable and have lower yields; long term bonds are riskier and less valuable and have higher yields.

Another thing about bonds is that, because they are a guaranteed stream of income, they’re a fairly safe investment. They’re safer than stocks, which do very well in good times but very badly in bad times.

So the price of stocks and bonds reflects expected future conditions. When the economy is expected to do badly, the price of stocks goes down and the price of bonds goes up (causing their yields to go down).

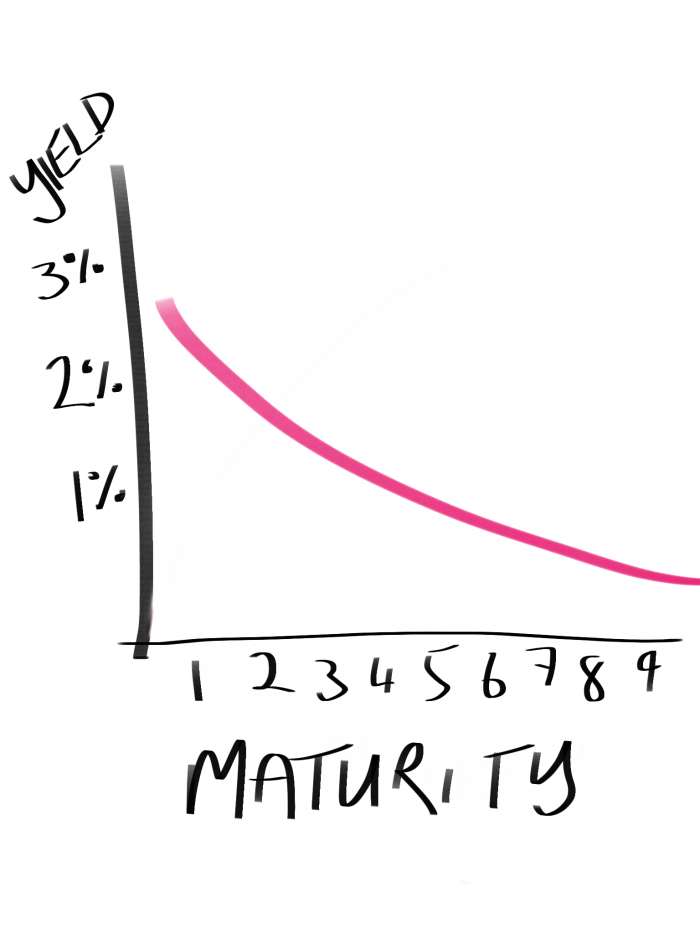

That takes us to an inverted yield curve. It’s exactly what it sounds like: a yield curve that slopes down and to the right, instead of up and to the right.

When a yield curve slopes down and to the right, what it means is that the market is starting to switch into recession mode. It’s bidding up the price (ie lowering the yield) of a safe, secure income stream. Even though, all things being equal, a bond that matures in the distant future should be cheaper (ie higher yielding) than one that matures tomorrow.

It’s worth wading through all this bond market terminology to get to the following punchline: when the yield curve inverts, it’s a reliable sign that a recession is on the way. Right now, the yield curve is flattening at great speed, and is headed for inversion territory.

The following chart shows the yield on US government 10-year bonds minus the yield on 2-year bonds. When the number is below zero, the 10-year is yielding less than the two year — an inverted yield curve. As you can see, every time the yield curve inverted (with the exception of 1998), a recession followed within six months or so.

The market has a way of knowing these things. What's really strange is the September 2019 inversion, which by February 2020 was being written off as an anomaly. One month later, the Covid recession was in full swing.

Let's assume bond investors got lucky in 2019, and they can't really see what's going on in Wuhan food markets. What can they predict?

The two big things government bond investors care about are inflation and recessions.

Bond investors hate inflation because a bond is a fixed stream of income. If inflation goes up the stream of income gets less valuable.

On the other hand, bond investors don't mind recessions too much. That's because bonds are a guaranteed income stream. That's pretty good when the markets are crashing. Recessions tend to push up the price of bonds.

So when the bond market is expecting inflation bond prices go down (yields go up), and when it's expecting recession bond prices go up (yields go down).

Where are we now? Inflation is starting to rise in the US and across the world. Central banks have to figure out what to do about it. Should they raise interest rates to kill off inflation now, at the risk of causing a recession? Or take it handy on interest rate rises, at the risk of letting inflation get out of control?

The fact that yields on long-dated bonds are falling is not what you'd expect to see if inflation were expected to fly out of control. Bonds hate inflation, remember. So why are long-dated bonds falling?

One possible explanation is that the bond market is expecting the central bank to screw up. It's expecting the Fed to overcompensate for rising inflation, and raise interest rates by so much that it creates a recession.

This isn't a crazy idea. It happens all the time. Jean-Claude Trichet's ECB mistakenly crashed the eurozone economy in 2011, which led to the whole eurozone sovereign debt crisis. And if you go back to the summer of 2008, before the Global Financial Crisis really got going, a small number of economists were shouting from the rooftops that the Fed was tightening too aggressively, and it was going to cause a recession.

We're not quite at inverted yield curve territory yet, though we're very close. So there's some wiggle room. But if the curve does invert, and bond investors are wrong, and there isn't a recession coming in a few months, it'll be only the second time in forty years.