Elon Musk isn’t wrong about Twitter. It is stuck.

It’s a mad company. On Twitter every day you’ll find the elite of politics, business, technology, media, entertainment and academia spouting off, along with 214 million other addicts.

It launched the political career of one US president and it’s been blamed for the collapse of the centre-ground in western politics, among other things.

Twitter knows more about its users’ interests, and how they think, than any other company. So you might think this thing – literally the nerve centre of western culture – would be insanely valuable.

But for shareholders, that’s now how it has worked out. Twitter is a dog. The following chart shows how Twitter has performed since its IPO in 2013, relative to Facebook/Meta.

Where did Twitter go wrong? At the risk of sounding obvious, it lost too much money for too long.

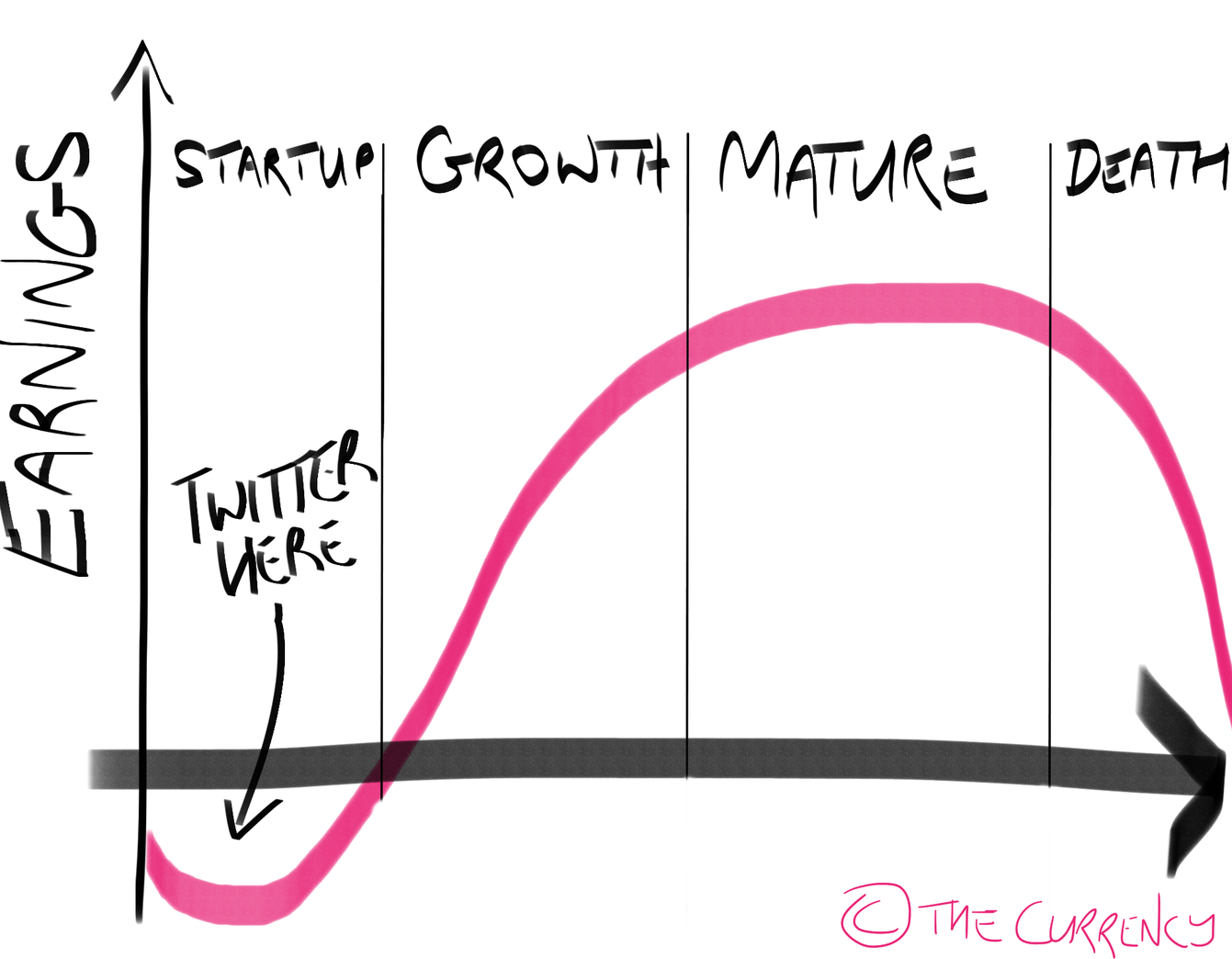

Start-ups have a licence to lose money. It’s expected of them. That’s because start-ups are in the business of exploiting new opportunities. And business opportunities don’t pay out straight away, like stumbling on an oil gusher. They have to be developed patiently over time.

Lots of money-losing start-ups die off. The ones who’ve found a genuine opportunity go to the next stage. They scale up. By this point they’re still investing in new opportunities, but their early investments have started to bear fruit. They start to make money.

Eventually, the company runs out of high-growth investment opportunities, because such things are finite. Now it’s a mature business living off the returns from earlier investments, like Diageo pumping out pints from St James’s Gate.

It might take decades to reach this point. Now the company can start to think about returning cash to shareholders as dividends. For shareholders, this harvest is what justifies the investments in the preceding years.

Indeed, in theory the reason a start-up is worth investing in on day one is the idea that, at some point many years hence, it’ll return the money many times over as a dividend. In the rush to make money by trading shares back and forth, this point gets missed sometimes.

Then a company dies, as they all must. The important thing here is for a company to accept its fate with dignity. Eventually, whatever investment opportunities that justified the company’s existence in the first place will go away, and the company won’t be better placed than anyone else to find new ones. This is when the company should wind itself down and hand cash back to shareholders, and let them go find the new thing.

Professor Aswath Damodaran of NYU said technology companies age in dog years. That is, they grow faster and die faster than regular companies. That’s because, in theory, technology companies scale quicker. It’s easier for Twitter to reach its audience by building a software system, than by trying to print 214 million daily newspapers. They die faster because the technology their business is built on goes obsolete, like MySpace or Yahoo. This makes Twitter's failure all the worse: the 16 year-old company is well into middle age, and still no prospect of returns.

You can see why investors piled money into Twitter as a start-up. It showed every sign of being a monster social network like Facebook/Meta. But for complicated reasons I struggle to understand, it failed to build a business. The following chart shows Twitter’s retained loss — which is its accumulated profit and loss since it was founded — alongside the share premium, which is the total amount of funding investors have poured into it.

Investors expected Twitter to follow the normal technology life cycle: early losses, cash burn, massive reinvestment, followed by steeply growing profits and, eventually, dividends.

But somehow, Twitter’s investments never came good. This is where Musk comes in. Musk said in a statement:

“I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.

However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.”

Is Musk the right man to own Twitter? Professor Damodaran made the point that there is no template for a perfect CEO. A company needs different traits at different parts of its life cycle. A young company needs a Steve Jobs-style visionary who can find investment opportunities; a mature company needs a Tim Cook-style organiser who makes smart decisions on how to finance the company, how much to invest and how much capital to return to shareholders.

Twitter finds itself 16 years old, still in the start-up phase, like a forty-year-old still living with their parents. Many have tried to reform it and many have failed. Musk will need a big idea.