I got an oddly post-apocalyptic vibe off the website of the failing cryptocurrency lender Celsius, when I visited it for the first time this week. I felt like the replicant K wandering the dust-covered streets of Las Vegas in Blade Runner 2049.

All over the site are pictures of contented customers, gently encouraging you to deposit your money on the Celsius platform. The logos of state and federal regulators are prominently displayed, as are those of reputable news outlets such as Bloomberg and Business Insider.

After a few clicks, the site funnels me to its big offer: a crypto savings product yielding up to 18 per cent.

But because I know what’s been happening with Celsius, I know that this week, people aren’t visiting the site to deposit money. They’re trying to get their money back.

Nosing around, are some signs Celsius is in distress. A discreet banner at the top of the page notes that withdrawals are currently paused. A graphic boasts of 151,000 bitcoin worth of assets (about $3.5 billion), which strikes me as odd – why are they denominated in Bitcoin? A visit to the Wayback Archive shows that in December of last year, the asset pool was denominated in dollars — and it was nearly seven times bigger, at $24.1 billion. Knowing what we know, the corporate mission statement reads differently:

“Those other guys are driven by profits, margins, bonuses, and their own bottom line. And while all of these things are perfectly reasonable motivating factors to achieve success in business, we at Celsius are driven by a deeper, broader mission in which success is measured by our external impact rather than our internal bottom line.”

(Worth noting here that Celsius minted its own coin and sold it to the public, and last year the thing was worth $1.6 billion, and that a funding round last year made Celsius’s founder, Alex Mashinski, a billionaire on paper.)

The mission statement section continues:

“An economy where financial freedom doesn’t come with a price tag. Where the interests of the people are put first. Where ethical behaviour is the baseline, and where everyone – and we mean everyone – has the opportunity to succeed financially. With a little bit of humanity and honesty, and the power of a digital currency that’s as strong as it is accessible, we’re ushering in the new economy today.”

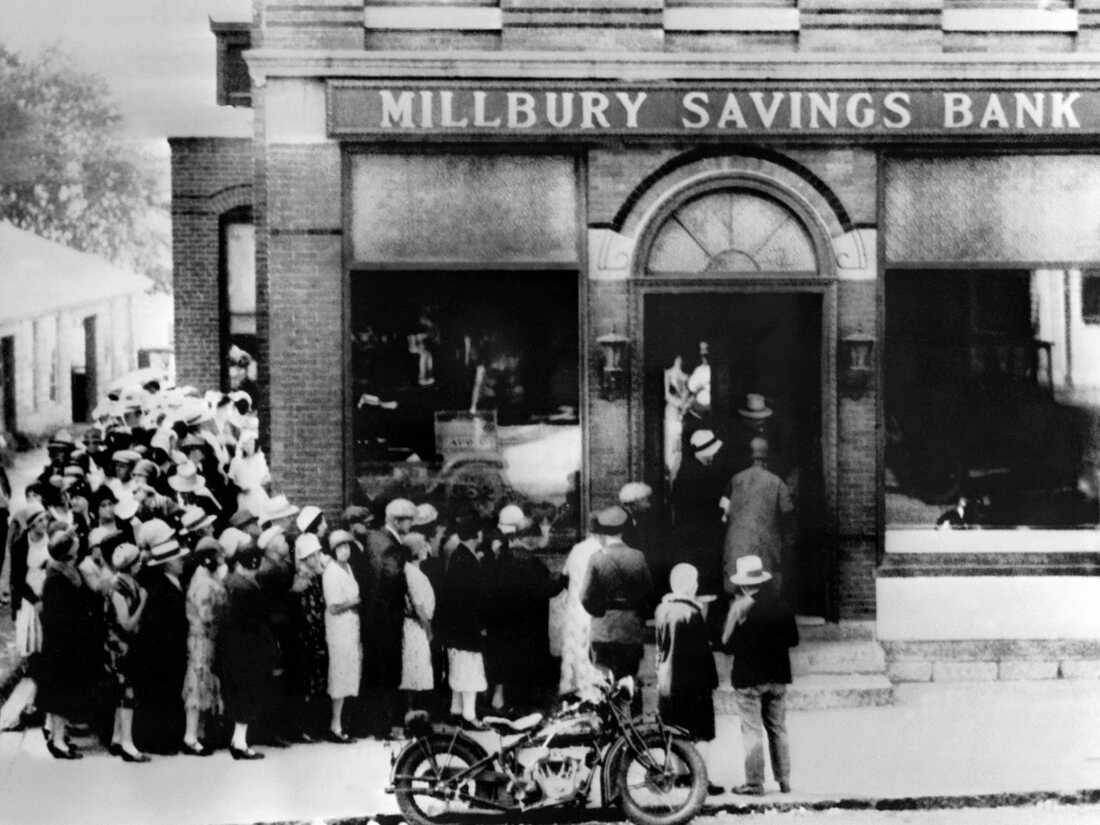

The bank run

The appeal of Celsius was that it offered traditional financial services to the crypto crowd. Crypto investors who wanted to invest in something safer than a Dogecoin could deposit with Celsius, and make a healthy rate of interest in the process. The imprimatur of the Securities and Exchange Commission and other regulators gave the impression of solidity.

The other benefit of Celsius is that it allowed crypto investors to convert some of their crypto winnings into cash without crystallising a big tax liability. Crypto investors could borrow cash from Celsius, posting their crypto as collateral. Then they could repay with the crypto, incurring no capital gain in the process.

What happened to Celsius this year? When the crypto markets turned, people started to worry about depositing their coins with Celsius, so they asked for them back. At some point Celsius lost control of the process, and on Sunday it had to pause all withdrawals. When a lender stops depositors from withdrawing their funds — that’s called a bank run.

How did the Celsius model work? Nosing around the website, there’s plenty of hogwash about values and a new economy and financial freedom. There are also big buttons with big numbers on them, prominently advertising the 18 per cent yields. But nothing I could find about exactly how the company generates those yields — who does it loan money to? On what terms? For what duration?

Celsius’s rates depend on the coin being deposited. It offers between 3 and 8 per cent on Bitcoin, 4 and 7 per cent on Ether, and 9 and 11 per cent on Tether. Depositors get a bonus if they accept payment in the Celsius coin, CEL.

The benefit to Celsius shareholders of minting a CEL coin, and encouraging Celsius users to get paid in it, are clear: they get to issue some computer code which, if successful, might in time be worth billions ($1.6 billion last summer).

But you might also ask what problem the CEL coin was solving, apart from making its issuers rich? Celsius is a fairly traditional borrowing and lending business. How did putting the decentralised token out there help anyone?

The slowdown in crypto in the last six months undoubtedly drained confidence from Celsius’s depositors. And the culmination of the bank run this week hasn’t helped in the other direction: crypto prices have tanked. $250 billion has been wiped off the value of all cryptos since Sunday, which is a little over 20 per cent of their total value. Since last November, cryptos have lost almost $2 trillion in value, which is a bit over two-thirds of their total value.

The saddest thing about the failure of a project like Celsius, or Terra last month, is that they were marketed as low risk. They were seen as safe investments — and hence, a place where you might deposit a large percentage of your net worth. The money that will be lost if Celsius goes down won’t be “invest only what you can afford to lose” money. It’ll be people’s life savings.

Celsius’s founder, Mashinsky, told Bloomberg that Celsius has been able to pay such high interest rates because the traditional financial system is underpaying depositors. “Somebody is lying,” he said. “Either the bank is lying or Celsius is lying.”