In his first column for The Currency last week, the economist Dan O’Brien succinctly encapsulated the myriad contradictions that define the Irish economy right now.

The raw data tells the story of a booming economy. Yet, few indicators point to a bubble.

The way O’Brien sees it, the scale and multi-sector nature of job growth best illustrates the strength of the economy right now. Even the hospitality sector, ravaged by a spate of closures, was employing more people in the early summer of this year than in the last Covid-free year of 2019.

As O’Brien notes, the number of people who go to work in white collars and white coats has swelled in line with the twin engines of pharma and tech.

And yet, the economist harbours some concerns. There is the spectre of a Trump presidency with its potential for tariffs. There are company and sector-specific issues too, like Intel’s ongoing woes (as covered extensively by John Reynolds yesterday) and TikTok, which is at the centre of geopolitical friction. Both are heavy employers in Ireland.

The country’s reliance on multinationals has never been greater, and their financial contribution has never been stronger. If global trade fissure threatens multinationals, Ireland is frighteningly exposed.

Meanwhile, as Dan outlines, the domestic economy needs to become more robust, more innovative, and more competitive.

In his interview with me last week, John Collison, the co-founder and president of Stripe, went further. Collison says that Ireland’s economic success was founded on radical ideas, but, in the interview, he wondered if complacency has seeped into the system.

Collison specifically pointed to the difficulties of developing infrastructure in Ireland, from houses to data centres to transport.

Quoting the economist Stephen Kinsella, Collison described the contradiction as “supply-side progressivism”.

“So many countries have demand problems, pretty significant demand problems at that. No one wants to invest in them. No one wants to create jobs there,” Collison said. “In Ireland, we are blown back by the fire hose of demand and it is the supply of housing, of infrastructure, of all these things where the issues are.”

Paschal Donohoe, arguably the country’s most influential policymaker, acknowledged many of the issues in his interview with me last week but countered that the Government had sought to derisk the economy by siphoning capital into long-term funds and by increasing capital investment while maintaining budgetary surpluses.

These are all important issues. And they are equally complex and multi-faceted.

But we must discuss them seriously.

Once we launched The Currencly five years ago, one of our stated goals was to do just that. Sometimes, we fail. Sometimes, we fall short.

But a central theme of our coverage over the past five years has been our effort to interrogate those issues that matter, to examine the future of the economy, and to help understand the contradictions that underpin the country. We attempt to do this when we look at national policymaking, and we also seek to do it when we report on entrepreneurs, business leaders, or corporations.

At times, it is a case of putting together the pieces of a jigsaw. For example, it is impossible to have a serious discussion about the public finances without understanding the tax tactics of multinationals. Likewise, a discussion on innovation will often lead back to housing. Much is connected.

This week, to celebrate our fifth birthday, we published a string of major interviews, features, and investigations. When you weave them together, they showcase the type of journalism we aspire to produce, but they also help tell a wider story.

Here is a recap of the past week.

Thirty years and still facing its “biggest opportunity”: Inside DCC’s constant evolution

DCC is one of the most consistently profitable and quietly remarkable businesses in corporate Ireland. It employs 16,000 people, has revenues of £20 billion (€23.8 million) and its dividend policy is superb.

It is making more money from the green transition than most comparable businesses.

In May, analyst Rory Gillen described its record of growth as “on a par with the iconic Berkshire Hathaway”.

Gillen concluded that perhaps only half a dozen European companies have been able to grow as much over the same 30-year period.

And yet, as Tom reported last week, it is unloved by the stock market.

In fact, I would bet most people in Ireland would struggle to tell you what it does.

Yet, it does it successfully. Tom sat down with its chief executive Donal Murphy to understand what other businesses can learn from its longevity, and its capacity to quietly, and consistently, evolve.

The great challenge for DCC and Murphy is to convince the market of its value. “If we look back in 10 years’ time and we have succeeded and delivered on our objectives, we’ll have a phenomenal business that has really impacted climate change issues for the better,” Murphy told Tom.

Opportunity knocks: The future of independent television in Ireland

In March 2021, The Currency sat down with Pat Kiely.

Kiely had just recently left his job as managing director of Virgin Media Television to launch BiggerStage, a television production company he believed could carve out a profitable niche developing content for overseas markets on behalf of international networks.

It was, pardon the pun, a virgin market. No one else was doing it. But, as he explained the model, Kiely was evangelical about its potential. “The opportunity for us as a business is to be outward-facing, to look at the opportunities outside of Ireland and use that to help fuel the ambition for the business within Ireland,” he told The Currency.

Four years and a partnership deal with Fox Entertainment later, the model has been validated. As Francesca reported last week, the company is now a major FDI business, channelling millions of dollars of investment into Irish TV production. The output, for the most part, is a series of shiny-floor Fox gameshows, made in Ireland for a US audience including The Floor, Name that Tune, Next Level Chef, and Beat Shazam.

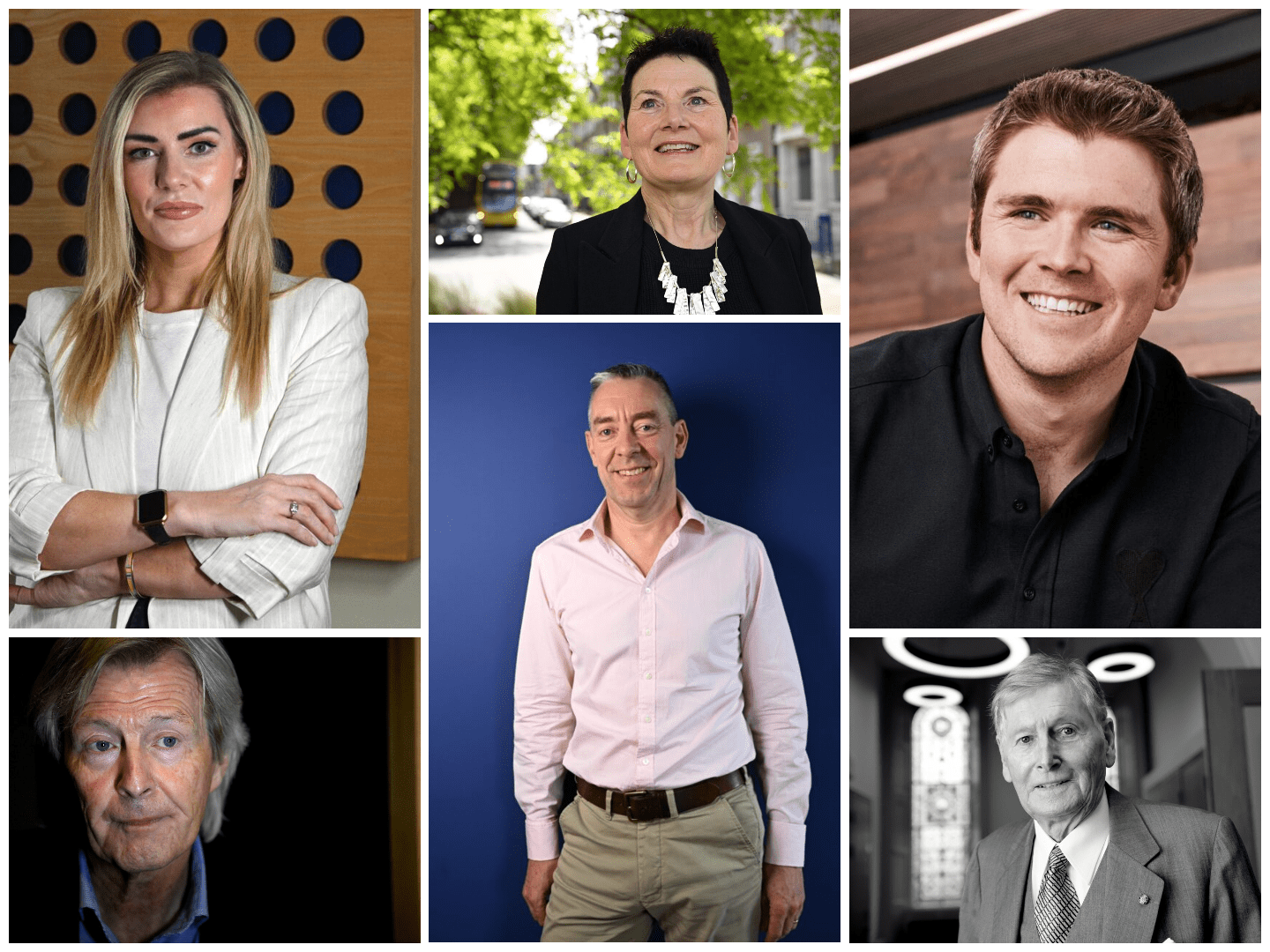

Francesca spoke at length to the company and to others within the independent television production sector including Screen Producers Ireland (SPI), Ardmore Studios, and the heads of three of the independent production companies that make up the backbone of Irish TV output: Debbie Thornton of Animo, Linda Cullen of COCO Content and Darren Smith of Kite Entertainment.

Against a backdrop of a struggling RTÉ, this piece aims to highlight the work of the independents, their increased importance going forward, and what they need to continue delivering quality popular programming with or without a public service remit.

As Francesca put it: “The result is a story about renewal, ingenuity and opportunity in an industry that may once have felt its best days were in the past.”

Michael Smurfit on life, deals, and industry: “We’ve built brick on brick, year on year, decade on decade – not overnight”

Michael Smurfit was sitting at a set table to the right of the entrance of the Lady Ann Magee yacht when Tom arrived in Monaco to interview him. The industrialist had a bottle of fine wine open to breathe and one of his staff opened another equally fine bottle of wine as Tom sat down. Behind Smurfit were three photographs: one with his close friend Prince Albert of Monaco, and the others of his family.

Over the hours that followed, they talked about many things: life, business, family, money.

This was all detailed in a fascinating portrait of Michael Smurfit, published on Tuesday.

“I never had a moment in my life when money didn’t count,” Smurfit told Tom. “But in line with my growth, with my wealth and the company’s growth, I kept my feet on the ground, I think.”

Smurft took Tom through the rise of the Smurfit group, and the deals that copperfastened his legacy as Ireland’s greatest CEO. But he also showed a human side, particularly when he reflected on age and mortality.

“I’ve no idea where I’m going. I know it’s a one-way trip. It’s a one-way trip for everybody. I’m alone on the bandwagon. I’m the last of the Mohicans, nearly, with all the group of friends I had in my life in Ireland.”

As Tom commented last week, building a global business is very hard, something few Irish business leaders have managed.

“It is almost impossible to become number one at something that a lot of people do in every country. The odds are stacked against you,” Tom wrote. “Yet, it is something the Smurfit family has done.”

The real capital of (derelict) Ireland: Cork, ground zero of the dereliction crisis

The housing crisis is the dominant social and political issue of our time. It impacts everything from demography to social cohesion to our economic well-being. We have adopted a data-driven approach to the topic. Yes, we have covered the individual stories, but we have also sought to use the underlying data to assess the causes of, and the solutions to, the crisis.

This was evident in Niall’s deep dive on property dereliction in Cork, published on Thursday.

His work involved trawling through over 100 cases in the council’s register to identify specific sites and owners, and then cross-referencing the list with planning cases, legal files and land registration documents.

This allowed him to pinpoint key case studies in the city that epitomise where owners have sat on properties for years with no action from authorities.

Importantly, however, Niall could identify properties where developers were making clear progress with redevelopment or were being held up in the planning system, yet remained on the council’s list.

There are over 160 properties on the city council’s public-facing derelict site register, almost half of which were added after a council survey of 13,000 properties last summer. Since the start of 2023, 86 sites were added to the list, while just 24 were removed.

The true figure is likely higher, with numerous other sites currently under investigation for dereliction.

“There is no quick fix to the twin housing and hoarding crises, but hopefully, this article sheds some light on where the key problems lie and where enforcement mixed with meaningful incentives can help make dereliction a thing of the past,” he wrote in his email commentary to accompany the piece.

Paranoia, complacency and Stripe: Inside the mind of John Collison

John and Patrick Collison have built one of the most valuable private companies in the world – some analysts put Stripe top of the rankings.

The fintech giant was valued at $70 billion after a recent share transaction, a figure that is up on a $50 billion low last year, yet down on its peak $95 billion 2021 valuation.

The brothers are billionaires many times over. Despite spending much of their time in the US, both have retained deep connections with Ireland.

That was obvious in my interview with John Collison, the Stripe co-founder and president, published on Friday. Collison readily agreed to an interview on Ireland and its place in a rapidly evolving world, and over the course of the hour-long interview, he delved into everything from the housing crisis to the rights of ramblers across rural Ireland.

He is enthused about the country’s potential. As he puts it, the headwinds are in Ireland’s favour.

But he is concerned about the blockages to crucial infrastructure such as energy and housing. He calls for a more public conversation over how the wider planning system works and how Ireland makes decisions.

He points to IDA Ireland, something he describes as a “radical idea of its time”, and Ireland’s subsequent corporate tax strategy.

“It is funny to imagine trying to introduce the corporate tax policy that caused so much prosperity in Ireland in today’s environment. The debates would do your head in over it,” he said.

“We had all these radical ideas that worked. Now we are failing at a bunch of major investment ideas. It would be okay if we were failing and were really unhappy about it as a country. But we are failing at these opportunities and people seem to be okay about it.”

It was a prescient warning from a man who has invested deeply in Ireland.

How 200 companies and 700 documents tell the story of the fallen star of Irish hospitality

The deep dive by Thomas into the corporate structure and financial operations of the Press Up hospitality group was due to be published last week, but it got fast-tracked after creditors appointed a restructuring team to the group. This was quickly followed by a shareholder realignment and the appointment of receivers to three restaurant chains within the ground: Wowburger, Elephant & Castle, and Wagamama.

Slowly, surely, Thomas analysed more than 700 documents filed by more than 200 companies to tell the story of how Ireland’s once fastest-growing hospitality empire became entangled in a choking web of debt.

It was not the first time that Thomas had unpicked a byzantine corporate structure. But it is a prime example of how we seek to shine a light on the operations of major businesses.

*****

As we celebrate five years in business, I just want to take this opportunity to thank all the people who have helped us along the way. They are many and varied. And, I specifically want to thank you, our readers. It would not be possible without you.