In the last two years, we have published more than 2,250 articles and some 150 podcasts. It is far more than what we anticipated when we were sketching out the plan for The Currency before launch. But we have been able to increase the volume of articles due to the ongoing support we have received from members.

To celebrate our second birthday, I have rummaged through our statistics to look at what pieces have been the most read over that period. There are several caveats, however. For a start, many of the articles are older, as it takes time for a story to work its way up the rankings – we always said that we wanted pieces that could stand the test of time and give insights over a long period of time.

Just because they are the most read does not necessarily mean they are the best, or the most impactful. Likewise, it does not reflect how long people stayed reading each story. Nonetheless, it does give a guide towards member behaviour.

Below is a list of 30 of our most-read stories. It is not the definitive list, and a number of our most-read stories were breaking news articles, such as when Tom revealed that Conor McGregor had bought a pub in Dublin (McGregor engaged with the story on social media, leading to the site to temporarily collapse from the influx of his fans). Likewise, out exclusive that Pfizer was looking to manufacturing Covid vaccines in Ireland features prominently. Another exclusive – John Collison’s involvement in a consortium to acquire Weston Airport – generated significant traction.

I have also taken out duplication – a string of stories on the Davy bond scandal feature highly, which is hardly a surprise. In those instances, I have selected a piece that I feel best encapsulates the issue or the topic.

*****

Leveraging surrender: How IBRC followed the Quinn money trail

This was the first story published by The Currency and it remains the most read. Drawing from a four-month investigation, it tells the story of how IBRC forced the Quinn family to surrender. It is a story of leverage; how the bank obtained that leverage, and how is then applied that leverage. It is a story of cutting deals with shady figures and shadowy firms, and of secret meetings in Dubai, Milan, Copenhagen, London and Zurich. It is also a story of money; how the bank followed a trail of offshore shelf companies in the United Arab Emirates, Belize, Panama and even Brunei to bank accounts in Hong Kong, Singapore, Liechtenstein and Dubai. And like most stories involving Irish life over the last 15 years, it is the story of property.

Davy in disgrace: The full three-part series

The Currency led the way in the coverage of the Davy bond scandal, a controversy that led to a spate of resignations and the ultimate sale of the broker. When the dust had settled, Tom spent four months uncovering exactly what had occurred and examining who knew what and when. Based on multiple sources, documents, courtroom filings and new information, we published a three-part exposé earlier this year. This is a link to the full investigation.

Pursuing paradise: The life and times of Johnny Ronan

This piece was first published in September 2019 during our first week in business. Yet, it still made its way to the most-read stories of 2020. This is hardly surprising – Ronan is one of Ireland’s most intriguing business figures, and this was his first major interview in decades. In it, he talked about family, fortune, feuds and his vision for Ireland.

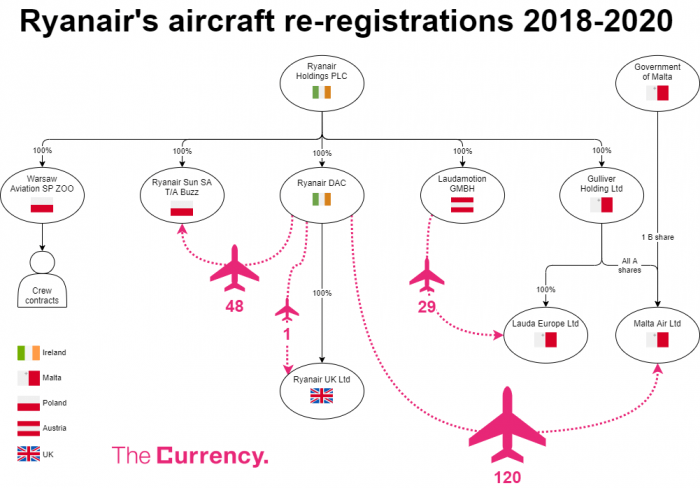

Flight risk: How Ryanair is quietly migrating its Irish business to Malta and Poland (and why it’s doing it)

We all know that Ryanair is an Irish airline. But is it really? In 2018, the airline’s entire fleet was registered in Ireland. Now, this is less than two thirds – and counting. And aircraft registration is just the tip of the iceberg. In March, Thomas revealed how the airline is slowly leaving Ireland.

Ireland’s about to get 1.1 million new citizens, and there are only three ways to accommodate them

Sean has written extensively about urban planning and the future of our towns and cities. This column really took off, when he argued that Ireland’s growing population gives it an opportunity to do something ambitious: Create dense, liveable cities as good as the best in Northern Europe and Japan.

“If you don’t get into my car, I will take that as you saying to me ‘F*** you’”

This was a sad, sobering but highly important story that we published in February when some 23 brave former students of Terenure College sent the man who had sexually abused them to prison. Tom Lyons, a student at Terenure College while John McClean was a teacher and rugby coach there, told a dark story of children betrayed by a prestigious school and religious order.

Inside Kinahan Crime Inc: The rise and rise of a global €1bn family business

When we think of the country’s biggest businesses, we normally look to the stock exchange, published results or valuations. Sadly, however, the Kinahan crime cartel is one of Ireland’s most significant enterprises, with substantial interests in commercial property and holiday resorts across Europe, South Africa and South America. The organisation has been linked with dealing in weapons and trading in huge shipments of drugs from South America – it has also become a specialist in fraud and money laundering. The EU’s security services have described Christy Kinahan as the chief executive of Kinahan Crime Inc, a global business, international property and criminal organisation valued at upwards of €1 billion. In this fascinating piece, Barry Cummins unravelled the Kinahan business empire.

U2 and me: Paul McGuinness on oligarchs in the Riviera, cutting deals with Steve Jobs and taking financial advice from Bono

Seven years ago, Paul McGuinness retired as manager of U2, and since then, he has been largely consumed with his successful TV show Riviera. However, beyond promoting the show, he has shied away from interviews and kept his counsel. On The Currency’s podcast in October, however, he opened up to Sam Smyth, a man he has known for 40 years. Sam had been looking for the interview for more than a year, but when it came, it was worth the wait. From cutting deals with Steve Jobs to dealing with oligarchs and taking financial advice from Bono, McGuiness was frank and honest.

Things fall apart – Champagne Football and the calamitous reign of John Delaney

Towards the end of last year, as we continued to expand the offering of The Currency, we started publishing in-depth reads every Saturday. Many related to sport, others to national controversies. Some related to business. This essay, by Dion Fanning, covered all three. The piece was in part a book review of Champagne Football, the brilliant exposé of John Delaney’s tenure at the helm of the FAI by Mark Tighe and Paul Rowan. But in the column, Dion also reflected on his own relationship with Delaney and placed Delaney’s dictatorial regime within a wider cultural space – of how Ireland operates and, more precisely, how Ireland can be operated.

Gannon’s gambit: Developer sues for possession of valuable lands beside Dublin Airport

Property is an area of huge focus for The Currency – from the issues to the developments to the players. This article about Gerry Gannon gained considerable traction. More than a decade on from the crash, property developer Gerry Gannon says he is still significantly indebted to Nama, and he now plans to put a vast car park in Santry on the market to pay down debts to the state agency.

Kerry didn’t lack hunger or any of the tired old clichés, what was missing was game management

In recent weeks, former Dublin GAA star Paul Flynn joined the team as our Gaelic football writer. His first column went viral, where he argued that Kerry need to be willing to learn from their defeat to Tyrone – and they need to be willing to learn the right lessons.

Human stories wrapped up in the meaning of words: The full story of FBD’s battle with Ireland’s publicans

We covered the battle between Ireland’s army of publicans and FBD over disputed Covid business interruption claims extensively on The Currency through multiple stories, features and insights. This feature was not the most read of the batch, but it is the best, and one that brings together the threads of a three-week court battle between the Irish insurer and a handful of pubs in a bitter test case.

I answered the phone. It was Liam Carroll. “All this talk of a lack of buildings,” he said. “It is time to start building again”

Liam Carroll passed away in March. For a period before the financial crash eroded his €5 billion property empire, he was perhaps the country’s biggest developer, building close to 9,000 apartments. He was personally low-profile, but his imprint remains all over our capital, wrote Tom in an obituary of the developer.

Fights, provocation and high fashion: The bitter dispute that almost tore the Kavanagh property empire apart

On March 7, 2020, Wales suffered its third successive defeat in the Six Nations, losing 33-30 to England at Twickenham. Later that night, Hugh Kavanagh, brother of the well-known developer Greg Kavanagh, went into Dublin city centre to meet up with friends. He says his brother Greg arrived having brought a large number of staff members from the start-up Bezzu out to dinner. According to Hugh, his younger brother Greg allegedly spent the night in town trying to provoke him. Over what, he doesn’t say. But he claimed they ultimately ended up in a late-night physical altercation. Two months later, the brothers wound up in what looked set to be a seriously contentious High Court family face-off. It was settled, but not before Francesca Comyn told the inside story of the dispute.

An essential service shorn of revenue: Why Dublin Bus could need €200m from the state this year

In May last year, as the full extent of the crisis was beginning to crystalise, Tom spoke with Ray Coyne, the chief executive of Dublin Bus. He explained how revenues had collapsed 90 per cent after the lockdown, and how a two-metre restriction would reduce bus capacity by 75 per cent. But he also spoke about the effort of his team during the crisis to keep buses on the road, ferrying essential workers to hospitals and food stores. He took Tom through the strategy for keeping the business and buses going and outlined the need for state support – something that many semi-states can empathise with.

Debt, a click-farm scandal and Covid-19: The rise and fall of Maximum Media

Over the course of last year, Tom Lyons led the way with his covering of Maximum Media, the owner of the Joe website. From revealing how it had gone into examinership to telling Niall McGarrry’s side of the story to ultimately revealing the new owners, Tom chronicled the ebbs and flows of the Irish media business. This particular piece was published in the aftermath of the company’s collapse into examinership. It revealed how financial problems had been mounting with the group before Covid-19, and how tensions were emerging with its main financial backer.

Artificial loans, turnover suppression, secret payroll runs: How some firms sought to game the wage subsidy scheme

It was designed to be free money to help the worst-impacted businesses maintain employment during the crisis. If turnover had collapsed by more than 25 per cent in the second quarter, the state, through the Revenue Commissioners, would subsidise the wages of employees up to a certain threshold. Availed of by 66,000 firms, the €2.8 billion wage subsidy scheme has been the cornerstone of the government’s economic response to Covid-19. However, in this piece, I revealed how it was being used by companies to manipulate the system.

Fiscally speaking: When Stephen Kinsella met Paschal Donohoe

Two days after a landmark €17.75bn budget designed to protect the economy from a pandemic, economist Stephen Kinsella spoke with Minister for Finance Paschal Donohoe about budgetary philosophy, the economics of deficits, and the power of the state. It was a fascinating interview. I had interviewed the minister on a number of occasions and felt it might be interesting to see how a non-journalist would tackle a politician. It was a brilliant discourse between two articulate voices.

Cerberus uncovered: How the hound of hell uses Dutch co-ops to guard Irish profits against tax

Over the course of the past two years, Thomas has done sterling work exposing the tactics used by multinationals and vulture funds to minimise their tax bills. On this occasion, he carried out a major investigation into Cerberus, a private equity giant that was among the biggest purchasers of distressed Irish debt during the last crisis. Thomas tracked a byzantine money trail devised by the fund and revealed how it was using opaque co-op laws in Holland to shield massive profits generated from Ireland from tax. It was a staggering investigation and one that led to multiple debates in the Dáil.

Inside Coolmore’s corporate empire: 75 companies, ten countries, three continents and one multi-billionaire

The complexity of the corporate structures behind horse breeding magnate John Magnier’s global investments has grown in tandem with his empire. A two-month investigation by Thomas explored dozens of firms in the Coolmore empire.

The life of a boxer at MTK Global: what a contract with the firm co-founded by Daniel Kinahan looks like

MTK Global is one of the most powerful forces in global boxing, despite being co-founded by the alleged drugs kingpin Daniel Kinahan. Boxers want to succeed. What does their MTK contracts mean for them? Tom has the answer.

Deconstructing Dolphin Trust: Inside the Irish liquidation of an alleged German “Ponzi scheme”

1,800 Irish investors are facing potential losses of €100m through Dolphin Trust. But how did it happen, and will they get their money back? Interviews with the Irish liquidators and others centrally involved reveal the status – and focus – of the Irish investigations.

“The closer Sinn Féin get to government in the south, the more they realise government is a difficult business”

As he joined The Currency as a columnist in June, Tommie Gorman reflected on the precarious position on the island and the personalities he knows intimately who have to find a solution.

Leo Varadkar on keeping businesses alive, pushing back on public health advice and rebuilding relations with the UK

In early October 2020, I spoke with Tánaiste Leo Varadkar. The interview came at a significant moment – the government was finalising its budget, while tensions were simmering between business and government over the pathway out of the lockdown. Before the interview, I was unsure of just how open the business minister would be. Afterwards, I was astounded by his frankness. In comments that triggered a national debate, Varadkar argued that Covid-19 case numbers might no longer be the best way to determine economic restrictions. He also spoke about his strategy for his new job, political priorities and as well as the vexed issue of Brexit.

Vulture structure: The €18bn debt deals that turned Ireland into CarVal’s bridge to the world

Much as he did with Cerberus, Thomas once again followed the money trail with CarVal, another major vulture fund. A month-long investigation revealed the inner workings of CarVal’s Irish buying spree – the structures, the discounts, the tax tactics and the profits. It also revealed the ongoing use of the Section 110 tax shelter, with the vulture fund now using it to buy assets all over the world.

All I want for Christmas is a trademark: Transatlantic battle for Black Irish name

This was something of a world exclusive and the story has been picked up by everyone from Vogue to the New York Times. When singer Mariah Carey launched her own cream liqueur, she chose the name Black Irish to reflect her ancestry. The brand is now live in the US but, although made in Ireland, it can’t be sold in the EU yet as a group of Irish drinks veterans own the trademark for their own Black Irish drink.

“I wasn’t prepared to undervalue the company”: Meet the woman who spurned four British dragons

Noelle O’Connor took investment from an Irish dragon but snubbed four offers on the British version of Dragon’s Den as she refused to cede too much equity in her organic tanning business. Now, celebrating its 10th birthday, she told Cáit how she was planning to launch TanOrganic in Poland and Germany.

Boards earn their money in times of crisis. So, who are the directors of the Beacon Hospital and how much are they paid?

The board of the Beacon Hospital boasts a former Taoiseach, a former head of AIB as well as the current chair of the SBCI, a state-owned bank. With the hospital engulfed in controversy, this heavy-hitting board must prove its worth.

A bitter pill: Behind the scenes at the embattled Cara Pharmacy Group

Ramona Nicholas and her husband Canice wanted to build an international chain of 100 pharmacies. Instead, in September 2020, their Cara Pharmacy Group went into examinership following a petition by their largest backer. Confidential documents reveal the true scale of the company’s financial woes, including a history of losses, debt, and creditor default.

A West Cork hotel, a nuclear winter and the spy left out in the cold

Sold in January for €3.5m, the Liss Ard Estate outside Skibbereen was a regular venue for literary and music events. But it is the story of Albert Bachmann, the Swiss spy who fell in love with West Cork, and who the estate in the 1970s which continues to intrigue.

Your new neighbour is JP Morgan: why global capital is piling into Irish social housing

After offices and apartments, the firehose of global capital is now pointed at Irish social housing. Who are the new owners, and what is it going to do to the Irish property market? Sean unpicked the detail.